In April 2020 we published a paper on Mobile money recommendations to central banks in response to COVID-19. This paper examined the impact of COVID-19 on mobile money business and provides broad recommendations that can be taken to ensure business continuity and sustainability.

In July 2020 we released the COVID-19 Response Tracker that monitors mobile money-specific regulatory, policy, government and provider interventions globally, collated using both primary and secondary sources. The current version of the tracker has been updated during the first week of September 2020. The tracker is intended to support mobile money providers and regulators with a mobile money-specific policy response database and learnings from other markets, in order to effectively tailor policy responses for their market.

An analysis of the data collated in the updated tracker showed preferred policy response instrument, regional variations, and the validity period of these instruments, summarised below.

Range of mobile money policy responses

The tracker collates data from 32 countries, spread across Sub-Saharan Africa (17), East Asia & Pacific (7), South Asia (4), Middle East & North Africa (3), and Latin America & Caribbean (1). For the purpose of this analysis, we have looked at East Asia & Pacific and South Asia together as the Asia-Pacific (APAC) region. Building onto our work around central bank recommendations, measures taken are categorised into eight broad categories i.e. fee waivers, increasing transaction & balance limit, flexible KYC and on-boarding, and social and humanitarian transfers, essential service declarations, support to agents, and others.

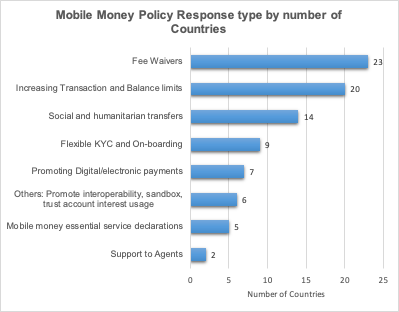

Fee waivers, increasing transaction and balance limits, and social and humanitarian transfers, are the most commonly used regulatory measures to fight the immediate impact of COVID-19. These measures also make digital transactions accessible to all.

Figure 1: Mobile money policy response type by number of measures

Preferred policy response by region

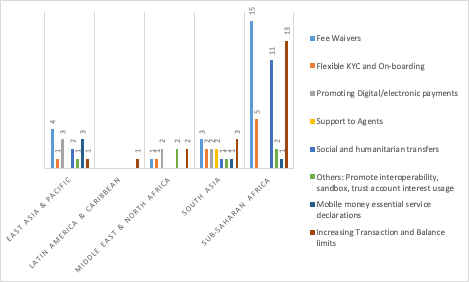

Figure 2 highlights the regional diversity in preferred regulatory policy instruments. It also illustrates how regulators in Sub-Saharan Africa have more actively leveraged mobile money-specific policy instruments in comparison to other regions. In terms of the popularity of policy responses by region, 15 out of 17 countries in SSA and seven out of 11 countries in APAC leveraged fee waiver as a preferred instrument to effectively respond to COVID-19. This was followed by promoting digital/electronic payments service in APAC, and increasing transaction and balance limit in SSA.

Figure 2: Mobile money policy response type by region

The validity period of Policy measures deployed

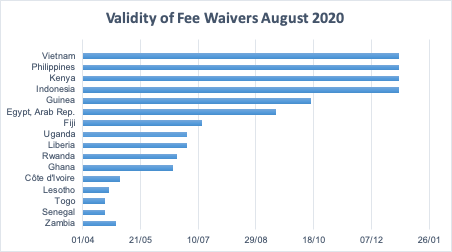

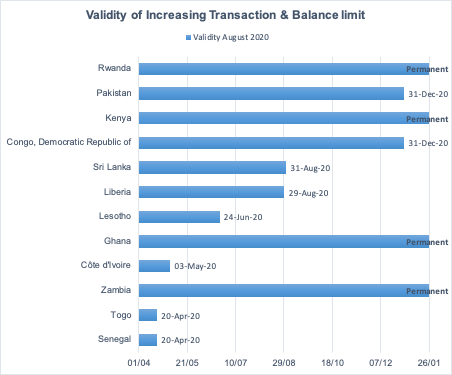

At the onset of COVID-19, we indicated that the regulatory measures are at best temporary, and geared towards limiting the spread of COVID-19 and alleviating the cost of living pressure on users of mobile money services during the pandemic. Regulators also need to ensure that these measures do not impair the long-term sustainability of the mobile money business. With this in mind, we have been tracking the validity period of these measures. Figures 2,3 and 4 present validity periods associated with Fee waivers, Increasing transaction and balance limits, and Flexible KYC and on-boarding.

A majority of the regulators have specified validity periods of COVID-19 specific fee waivers in the policy instrument released. The maximum validity of the fee waiver extends until year-end 2020 for four countries. A few countries allowed fee waivers for only 30 days from the date announced (with no clear indication of extension), while many others choose not to specify any validity period early on (hinting towards a wait and see approach).

Figure 3: Validity of fee waivers

Regulators in Kenya, Rwanda, Ghana and Zambia have made increased transaction and balance limit permanent. State Bank of Pakistan on 13th July 2020 also extended the validity period of this policy instrument from September 2020 to December 2020. This is followed by Liberia (August 2020).

Figure 4: Validity of increasing transaction and balance limit

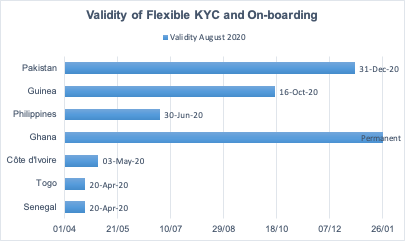

The BCEAO, which regulates mobile money services in several West African states, including Togo and Senegal, took a conservative approach by imposing this measure for only 30 days to 20 April 2020.

The Central Bank of the Republic of Guinea applied the flexible KYC and on-boarding measure for a six-month period until October 2020. The State Bank of Pakistan further extended the validity period of this policy response by 90 days to 31 December 2020. Ghana, as an example of best practice, has made flexible KYC and on-boarding permanent.

Figure 5: Validity of flexible KYC and on-boarding

Best practice response

On 18 June 2020, the National Bank of Rwanda (BNR) announced the reinstatement of mobile money transaction charges following three months of zero-rated transfers between bank accounts and mobile wallets (push and pull); mobile money person to person transfers; and merchant payments. The reason given for this decision was “the need to ensure financial sustainability of digital payment services”. The BNR added that it would continue to collaborate with public and private sector players “to ensure the resolution of impediments to digital payments, including any infrastructure, cost of service, financial and digital literacy, operational resilience as well as innovation.” The significance of BNR’s position cannot be overemphasised. However, more could be done. Regulators and mobile money providers in countries afflicted by the COVID-19 pandemic and suffering under the strain of the regulatory response measures could borrow a leaf from Rwanda’s example. A data-driven approach that relies on credible mobile money payments transaction data analysis on the impacts of the prevailing regulatory response measures is encouraged.

Please refer to our next blog in this series that will explore regulatory trends and implications in detail.

Blog last updated: 9 September 2020