When most people hear the phrase “to turn a profit, we need to manage our costs”, they usually take it to mean “to turn a profit, we need to reduceour costs”. But when it comes to mobile money, practitioners have found that some costs can be done away with more easily than others. So the trick, then, is to understand which are strategic (and must be protected), and which are discretionary (and can be curtailed).

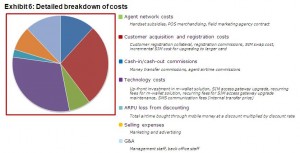

But before we begin our evaluation process, let’s first briefly take stock of the costs (and there are many) that are involved in launching a mobile money service. Before launch, MNOs incur a series of technology costs, including investing in an m-wallet platform, upgrading their SIM or USSD access gateway (in most cases), and deciding whether to embed their application on all new SIMs – and in most cases consequently upgrade to a larger card (while this isn’t a cash outlay at first, its a decision of major financial significance). The next tranche of costs are go-to-market related, and include recruiting and paying for management and back-office staff, training and merchandising a network of agents, and designing and launching above and below-the-line marketing campaigns. Most of the costs identified thus far carry on after the service has been launched, but the day a service goes live, a third set of costs come into play: ongoing costs. These typically include cash-in/cash-out agent commissions for agents, SIM cards, starter packs and agent registration commissions for customer acquisition, and internal transfer fees for using SMS services or selling airtime at a discount. For a full breakdown, refer to Exhibit 6.

So which of these are strategic and which, if any, are discretionary? Unfortunately, answering this question is not as simple as sorting costs according to size. If we look at the drivers for MTN Uganda’s MobileMoney, the service we’re using as the focal point for our profitability discussion on this blog, we find that highly strategic operational activities – things like building and managing an agent network, or providing great customer care – are comparatively inexpensive. Since launch, 7% of MobileMoney’s total costs have been on building and managing their agent network[1], and 4% has been on back-office customer care.[2] And while it’s true that Safaricom spends somewhat more on these particular activities, and has benefited from an agent network of industry leading quality, the insight is still applicable: these activities are routinely touted as strategic imperatives for any successful mobile money service – but for MTN, they’ve cost a pittance compared to the amount spent on technology[3] (30%) or customer registration commissions[4] (12%) to date.

So which of these are strategic and which, if any, are discretionary? Unfortunately, answering this question is not as simple as sorting costs according to size. If we look at the drivers for MTN Uganda’s MobileMoney, the service we’re using as the focal point for our profitability discussion on this blog, we find that highly strategic operational activities – things like building and managing an agent network, or providing great customer care – are comparatively inexpensive. Since launch, 7% of MobileMoney’s total costs have been on building and managing their agent network[1], and 4% has been on back-office customer care.[2] And while it’s true that Safaricom spends somewhat more on these particular activities, and has benefited from an agent network of industry leading quality, the insight is still applicable: these activities are routinely touted as strategic imperatives for any successful mobile money service – but for MTN, they’ve cost a pittance compared to the amount spent on technology[3] (30%) or customer registration commissions[4] (12%) to date.

So if these activities deliver such good value for money, why do some practitioners have a difficult time getting budget to do them properly? In many cases, this stems from the fact that highly strategic, financially insignificant costs often require a commitment to spend in advance of having any indication of whether the mobile money service will be a success. For instance, MTN had to commit to a fixed monthly contract with a field marketing agency ($623,000); pay for and train their dedicated call centre representatives ($440,000); and design and fund an above-the-line marketing campaign ($850,000) all prior to launching their service. Each of these activities has been instrumental in MTN Uganda’s success, and their decision to invest aggressively in them ultimately stemmed from their confidence that the service would become a hit.

But that’s not to say all of their spending has been strategic; some costs were discretionary, and potentially could have been substituted for less expensive, equally effective alternatives. For instance, MTN recently introduced an airtime bonus for customers who top-up using mobile money, an incentive many MNOs have used in an effort to encourage customers to top-up using their e-wallet. But this tactic was particularly costly since it negates a big portion of the savings realised from eliminating discounts paid to dealers.

Moreover, like they have in other markets, MTN has pursued a strategy of aggressively registering new customers in Uganda. In practice, this has meant registering more inactive customers (552,213) than active ones (421,254). And this strategy has been expensive: MTN has spent a total of $1.3 million on registration commissions and new SIM cards for customers that have not performed a single revenue-generating transaction (stay tuned to this blog for the findings of GSMA research into customer activation).

Profitability Series

1. Is there really any money in mobile money?

2. How much must an MNO invest in mobile money before turning a profit?

3. How significant are airtime distribution savings to profitability?

4. How significant are churn reduction benefits to profitability?

5. How significant is ARPU uplift to profitability?

6. How significant are direct revenues to profitability?

7. How can an MNO manage costs to achieve profitability?

8. How can MNOs ensure their tariff and commission models are well designed?

9. What metrics should an MNO monitor and manage?

[1]Includes handset subsidies, agent POS merchandising, and field marketing agency costs

[2] Includes total cost of back-office staff

[3] Includes cost of m-wallet platform and monthly charges, SIM access gateway upgrade and monthly maintenance charge, and SMS communication fees

[4] Includes commissions paid from MTN to agents ($1.33 per registration).