As part of a series of three country-focused reports that highlight pathways to digitising the last mile of agricultural value chains, we previously shared findings from Uganda and Côte d’Ivoire. In this blog, drawing on findings from our third report, we take a closer look at the last mile digitisation initiatives in Ghana.

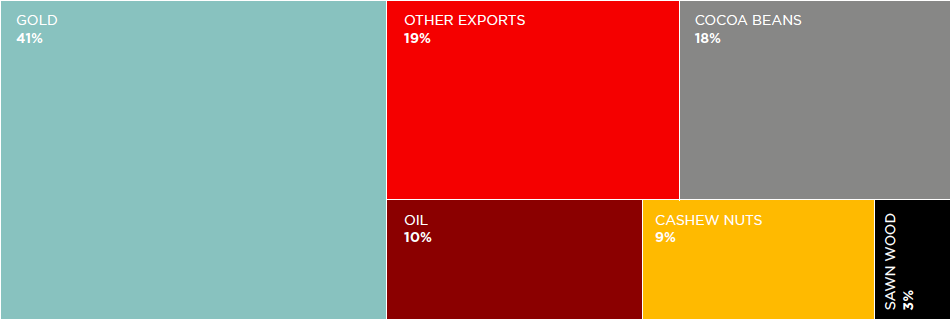

With agriculture contributing 19.6 per cent to national GDP and employing 45 per cent of the population, the sector is central to the Ghanaian economy. Despite being a lower-middle income country, Ghana has seen its exports dominated by agricultural products and natural resources, with industrial crops, namely cocoa and oil palm, being significant contributors.

Exploring agricultural digitisation in Ghana

As part of our research, we studied multiple initiatives that aim to digitise different aspects of the last mile of agricultural value chains. Of the four featured initiatives we present two that are Mobile Network Operator (MNOs) led mobile money deployments that incorporate procurement digitisation systems managed internally by the agribusinesses. The other two are examples of third party (agri-tech) led initiatives that digitise procurement and farmer registration modules and integrate with MNOs for mobile money payments.

Cargill, while purchasing cocoa beans from farmers through its licensed buying company, ensures digitised procurement records through a bar code tagging mechanism managed in-house while payments to farmers are processed through a mix of e-Zwitch and MTN and Tigo’s mobile money services. Until September 2017, 10,000 farmers had received premium payments through e-money while 25,000 had registered to receive payments through these channels in the future.

Ghana Rubber Estates Limited (GREL) is a rubber processing business near Takoradi that, aside from its own plantations, sources rubber from 9,000 outgrowers. At the time of procurement from outgrowers, the produce is weighed and quality tested, with both pieces of information captured in a last mile sourcing tool developed in-house by GREL. Outgrowers then receive a paper receipt and payment is executed via bank transfer or bulk payments using mobile money. While Tigo is the main partner for mobile money payments, GREL has recently also signed an agreement with MTN to support expansion of the service. As of September 2017, 1,400 farmers had registered to receive payments through mobile money and GREL aims to transition 50 per cent of its outgrower payments to digital channels by December 2018.

Meanwhile, third party agri-tech providers, such as Farmerline and Insyt, have developed digital solutions for data collection, management and analytics that have varied applications in agriculture and, in the case of Insyt, other industry verticals. Both tools allow for farmer profiling, field monitoring, procurement digitisation and farm mapping. Field staff use a mobile app interface for data collection while office-based staff have access to a web interface for analytics and reporting. Operating across multiple markets, Farmerline’s Enterprise tool has reached over 180,000 farmers while Insyt has been used to profile more than 34,000 farmers.

Farmerline – digital farm mapping Insyt: Overview Dashboard

Digitisation benefits all key stakeholders

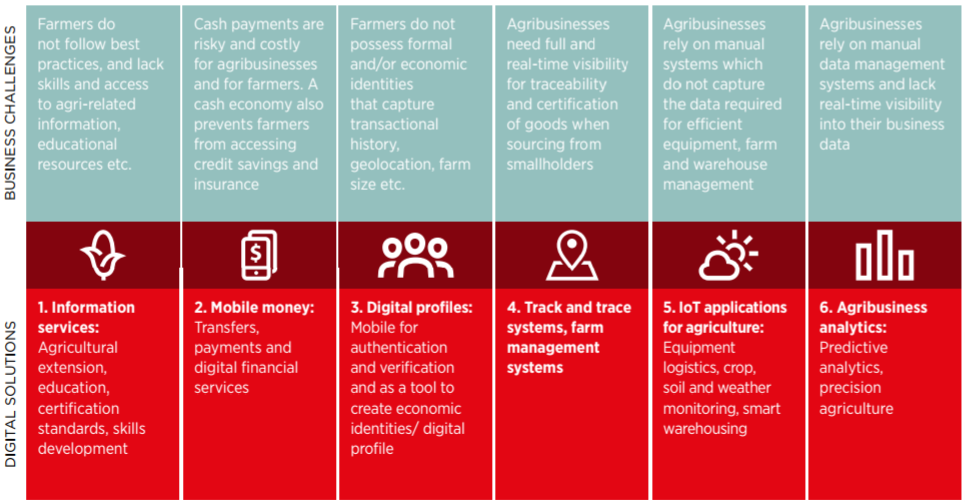

With more than 22 million registered and 10.6 million active mobile money accounts, the Ghanaian market is ripe for agricultural payments through mobile money. However, while mobile money is a key channel to help farmers access formal financial services, additional elements of economic identity and digital infrastructure need to be addressed in parallel to create an ecosystem supportive of holistic financial inclusion – thereby enabling the development and scaling of derivative financial services, such as savings, loans, and insurance products for agriculture.

In this context, last mile digitisation of agricultural value chains provides considerable benefits to farmers beyond basic financial inclusion. Digital payments allow for transparent transactions and reduced travel times/costs by providing nearby cash-out points. A mobile money account empowers farmers to make other digital transactions, such as utility, school and health fee payments. This transaction history, when combined with additional data points such as farm location and acreage, can provide a basis for credit scoring, paving the pathway to derivative financial services, such as agricultural credit.

Agribusinesses in Ghana, like in other markets, face last mile challenges related to cash handling when making farmer payments. Digital payments reduce the risk of injury or threat to life of field staff and loss of cash through theft or robbery. They also eliminate the costs of cash insurance and vaults, enhance transactional transparency and lower the risk of field fraud by purchasing clerks. More holistic enterprise solutions for digitising the last mile allow agribusinesses to address an array of business challenges across farmer registration and profiling, farmer advisory services and generating predictive analytics. These, in turn, help to increase farmer loyalty, operational efficiency and real-time visibility of last mile operations.

For MNOs, digitisation of last mile business to person (B2P) agricultural payments alone presents a $13.1 million annual revenue opportunity in Ghana by 2020. More importantly, as MNOs seek to enhance their presence in the digital ecosystem, there are opportunities to support agribusinesses that are streamlining their operations through farmer profiling, track and trace systems, predictive analytics and other procurement digitisation solutions. As MNOs often do not possess a deep understanding of agricultural value chains, field experience and an existing last mile digital solution, a clear opportunity exists for partnerships between agri-tech providers and MNOs to scale digital solutions in the last mile.

You can learn more about the existing digitisation landscape in Ghana, opportunities for further collaboration and insights from our research.