Direct deposits have become an expensive nuisance for mobile wallet operators by eating into revenue, weakening customer engagement, and stunting registration efforts. One operator estimates up to 40% of P2P transfers take place through direct deposits rather than the intended means and, anecdotally, this figure is not unusual.

First, what is a direct deposit? Direct deposits are the circumvention of the intended flow of a P2P transfer. A direct deposit occurs when the customer initiating a P2P transfer hands the agent cash, but provides them with the mobile number of the recipient rather than their own. The agent deposits the funds directly into the recipient’s account, allowing the sender to avoid the P2P transfer fee and process.

In this MMU Spotlight publication, we discuss the root causes of direct deposits, the harm they create in mobile money programs, and steps operators can take to prevent them. This will be of interest mobile money practitioners and those involved in managing mobile money agent networks.

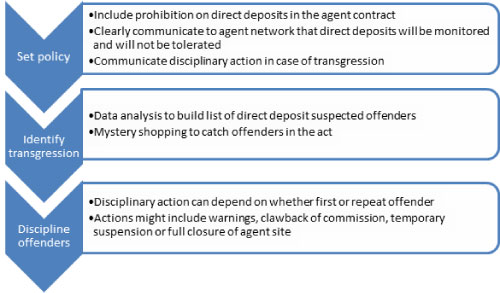

Preventing direct deposits: A framework for action

Please follow this link to read the full publication.

Mobile money practitioners: Are there approaches to direct deposits not covered in this publication that you would recommend? Please do let us know at [email protected] or by commenting on this post.