The post is part of a series looking at key findings from the 2014 State of the Industry Report on Mobile Financial Services.

Having looked at various aspects of mobile money, it’s time to move to the second part of the State of the Industry report, covering mobile insurance, credit and savings. In this post, I will take a closer look at mobile insurance services that are becoming increasingly widely available. The MMU Deployment Tracker shows that 10 new services were launched in 2014, taking the total to 100 live services across 30 different countries. Fifty-six of these mobile insurance services are led by MNOs.

Mobile insurance is scaling

Having found sustainable commercial and partnership models, mobile insurance services are now scaling: as of June 2014, 17 million policies had been issued representing annualised growth of 263%. Five services had provided more than one million policies.

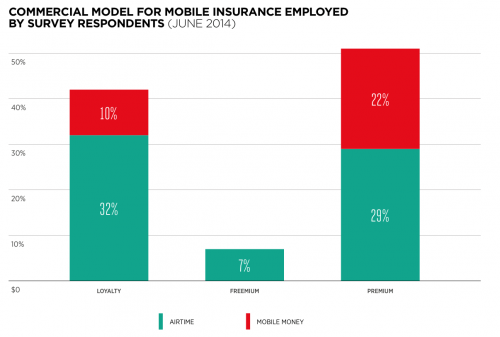

In the past few years, a number of mobile insurance providers have adopted new commercial models, which are changing the face of the industry. Rather than simply charging premiums for insurance, some service providers now provide insurance cover in return for loyalty, while others have adopted a “freemium” model, offering a basic level of cover for free to many customers in the hope that some customers will voluntarily upgrade and pay for more comprehensive cover. The figure below shows the split of mobile insurance services by commercial model and whether they are based on mobile money or airtime usage for loyalty, freemium and premium collection.

These new commercial models are used by all five of the scaled services (those with over 1 million policies issued) and have been pioneered by specialist solutions providers who have expertise in micro-insurance. According to respondents of the 2014 Global Adoption Survey, 64% of mobile insurance services had been launched by MNOs in partnership with a specialist solution provider. Now expanding rapidly, these specialists typically establish successful working partnerships with MNOs, adapting to mobile operators’ requirements, while providing plug and play solutions, which helps to avoid some of the technical challenges that others companies would face in integrating with MNOs’ systems.

After several years of experimentation, two distinct distribution models have emerged: low-touch and high-touch, both of which are proving to be successful in achieving scale

Two distinctly different models have emerged for distribution (which includes customer engagement, awareness and registration of services) with both proving to be successful in achieving scale. The first approach is a low-touch model, reliant on significant above-the-line marketing to create customer awareness. Customers can self-register or, in some cases, they are automatically enrolled and can opt-out via SMS. This model is often used when insurance is offered as a reward for loyalty, to reduce churn and increase the average revenue earned from a customer.

Low-touch models are reliant on significant above-the-line marketing spends to create customer awareness such as billboards, TV commercials and radio campaigns.

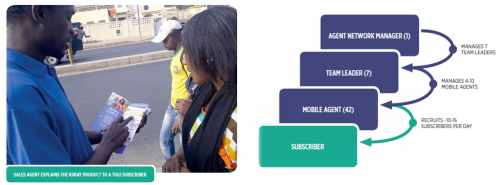

The second approach is a high-touch model, where agents educate consumers about insurance, explain the claims procedure and walk them through the mobile interface, in addition to enrolling customers in person. Arguably, this model results in better-educated customers who are more likely to pay for additional cover or additional products. The figure below (right) is an example of Bima’s distribution model in Senegal and highlights the number of people needed for a high-touch model to work.

In the final post in our series, we’ll discuss mobile credit and savings services. Read the entire section on mobile insurance in the 2014 State of the Industry Report on Mobile Financial Services.