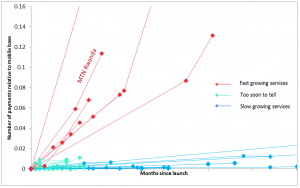

The 2011 Global Mobile Money Adoption Survey allowed us to identify 8 fast-growing mobile money services that are following the path of M-PESA in Kenya. Six of these 8 services are in East Africa, and after Kenya, Tanzania, and Uganda, the mobile money wave is now reaching Rwanda.

In this blog post, we feature MTN MobileMoney in Rwanda, one of the fastest-growing services across the world.

A few months ago, MMU travelled to Rwanda, and what we saw was really exciting: just like in Kenya, every person we talked to knew about mobile money and was a customer of either MTN MobileMoney or Tigo Cash, the two mobile money services available in Rwanda; and just like in Nairobi, where M-PESA agents are ubiquitous, mobile money agents were springing up everywhere in Kigali—often several in the same street.

MTN MobileMoney was launched in February 2010 in Rwanda. Two years after launch, it boasted 415,000 registered customers, and over 170,000 active customers—6% of MTN’s mobile base.

MTN MobileMoney was launched in February 2010 in Rwanda. Two years after launch, it boasted 415,000 registered customers, and over 170,000 active customers—6% of MTN’s mobile base.

We had the opportunity to interview Albert Kinuma, who heads MTN MobileMoney in Rwanda, at our last Working Group. In this video, he shares the story of MobileMoney in his country and gives his perspective on what the drivers of their early success have been. Key success factors include:

- An enabling regulatory environment: MTN is licensed directly by the National Bank of Rwanda to offer MobileMoney, which helped MTN bring MobileMoney to market quickly. Moreover, customer-due-diligence rules enable quick registration and activation.

- A focus on understanding and meeting customer needs: MTN invested heavily in market research to understand how Rwandans were likely to use the service, pilot testing with 200 customers and then listening closely to their feedback. They then fed these insights to the agency responsible for devising their marketing campaign to ensure that it would be relevant to the local market.

- A large dedicated team: a relatively large staff of 18 MTN employees manages the MobileMoney operation.

- A happy channel: MTN has carefully managed the growth of its agent network in order to ensure that agents are satisfied with the return that they earn from serving as MobileMoney agents. The average number of customers per agent is an indicator that management tracks closely; as of June 2011, there were 259 active MobileMoney customers per active agent in Rwanda.