In the past, many have asked if it is possible to replicate the mobile money success stories from Sub-Saharan Africa to other regions of the world with different macroeconomic, geographic and cultural settings. This question is particularly relevant in a region like Latin America, where half of the population is not served by the traditional financial sector.

For almost a decade, Paraguay has been answering this question affirmatively. Nowadays the Paraguayan mobile money industry is the most successful and well-established example from the Latin American region and it is among the most dynamic industries in the world. In a country with a financial inclusion rate of only 29%, it is remarkable and very encouraging to learn that, in the past years, mobile money usage has almost caught up with that of bank accounts, with 28% of the population using mobile money and another 10% expected to use it in the next year.

Today, we are releasing a new case study in Spanish which traces the different stages of the mobile money regulation in Paraguay, from its inception to the design and implementation of an enabling regulatory model, showing that by creating such regulation and nurturing new technologies such as mobile money, regulators can be agents of change for financial inclusion.

Many factors have contributed to the success of mobile money in Paraguay:among them, the low levels of financial inclusion, the sustained growth of its agricultural industry, and the high penetration of the mobile industry. Nevertheless, the Paraguayan mobile money providers have only been allowed to flourish thanks to the test and learn approach taken by the financial regulators.

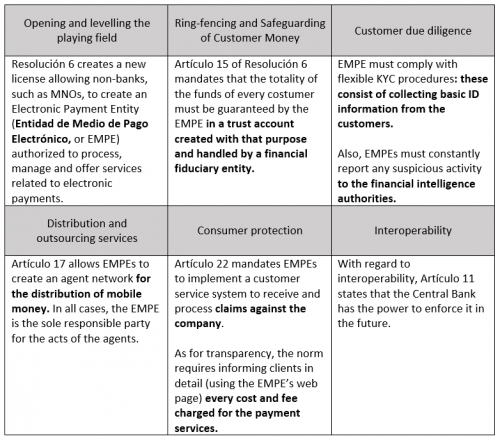

After many years of sustained growth of the mobile money industry in Paraguay, and having proved its positive social impact, in 2014, the Banco Central de Paraguay (BCP) issued the Resolución 6, an integral regulatory framework formalizing the mobile money industry. This important milestone gives much-needed legal stability to the industry, allowing further investment required to scale the reach of these services.

The Resolución 6 is the final result of a very well-structured process, in which BCP closely watched the industry’s development and had an open dialogue with each stakeholder. In addition, the Resolución 6 is part of a wider public policy contained in the National Financial Inclusion Strategy, which was designed and implemented by the Central Government, but involves all the different public and private stakeholders. The Resolución 6 incorporates the necessary regulatory principles to be considered an enabling mobile money regulatory framework. [1]

Lessons for regulators

- A successful test and learn approach allows a market-led development of the industry.

- This allows the regulator to learn about the day-to-day reality of the business, so when the time comes to issue the regulation, there is clarity on the market’s and the consumers’ needs.

- It is paramount to constantly follow the industry’s development and to have an open and sincere dialogue with it. Building trust among the industry and the regulator is key to understanding the different business models and the risks associated with them.

- It is very important to set up institutional coordination authorities that facilitate an organized and cooperative implementation of the rules and policies. In Paraguay’s case, the Government created the Executive Secretary for Financial Inclusion. This office is in charge of leading the dialogues with the private sector and among public agencies.

Lessons for the industry

- Establish a direct relationship with the regulators, seeking to understand their perspective and public policy concerns.

- Keep a transparent dialogue with the regulator and the public, informing them about the developments of the business, its potential and areas for improvement.

- Identify the public policy objectives and the role the industry can play to help achieve the Government’s goals.

- Understand that the nature of the relationship between the regulator and the industry is dynamic and it can change as the business models develop.

Download the case study. At the moment, the publication is available in Spanish only.