We are on the cusp of the most profound change in the mobile money business model since the service was launched over a decade ago.

Processing over a billion dollars a day, mobile money has evolved into the leading digital payment service in many emerging markets. Yet, significant changes in the commercial and technological landscapes mean that mobile money of tomorrow is likely to be based on a new business model. This blog is the first in a series of insights related to the payments as a platform approach.

The majority of future growth in mobile internet and smartphone adoption is projected to come from regions with high mobile money uptake. Having reached scale, many successful mobile money providers are also working to maximise what customers can do with a mobile money account. This, combined with rising competition from fintech and internet platforms, is driving a fundamental change in the approach to mobile money.

Providers are evolving to serve as payment platforms that connect consumers with third-party services across different industries. Assets such as large customer bases, diverse datasets, wide distribution networks, and trusted brands are proving essential to this transition, and a strategy focussed on partnerships and consumer experience is equally important to leverage these assets effectively. Safaricom’s launch of Daraja, an API portal for businesses to integrate their services with M-Pesa, is an example of how some leading mobile money providers are already exploring a business model that prioritises third-party innovation.

What does a mobile money platform look like?

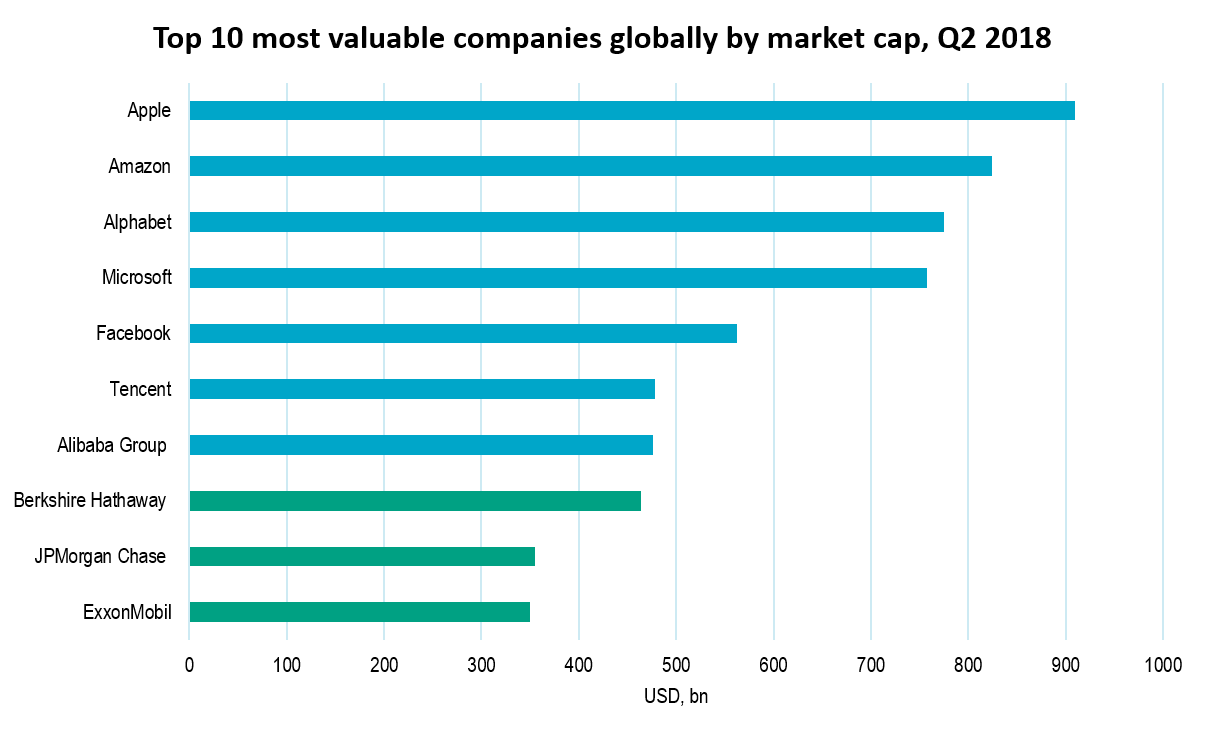

Platform-based business models are the favoured operating model for seven of the world’s ten most valuable companies: Apple, Amazon, Alphabet, Microsoft, Facebook, Tencent and Alibaba Group. We studied more than 20 platform business models that were either led by financial service providers (such as banks, payment service providers, fintechs, mobile money providers and payment schemes) or by other types of providers (such as e-commerce and social networks.). Initiatives were selected based on their success and relevance to the mobile money industry, and a desire to highlight examples of how platform models are working in different regions. We found that while digital platforms can take many forms, they tend to share certain basic characteristics.

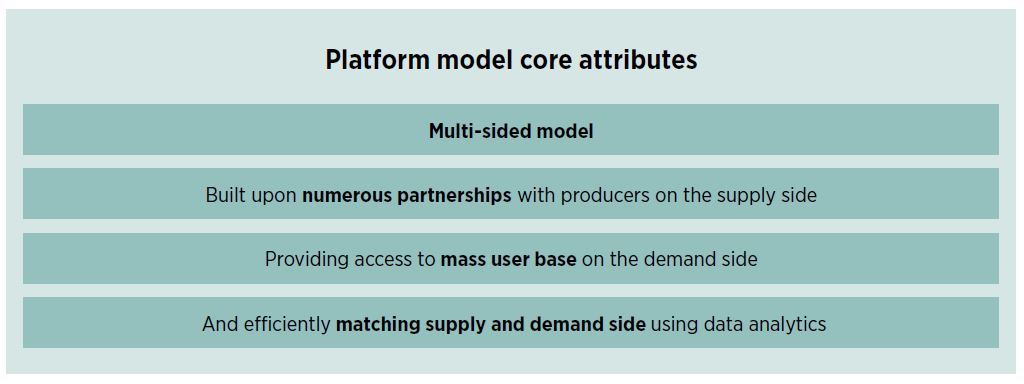

Based on these benchmark studies, we identified the core attributes of a mobile money payment platform.

Platforms rely on an ecosystem of partners to serve end-users. They do this by connecting producers (supply side) to users (demand side) through, for example, a digital interface and mutually agreed rules that enable parties on both sides of the platform to interact efficiently and with trust. The number and variety of partnerships are central to the success of digital platforms. In China, for instance, Ant Financial has built an ecosystem of partners, including over 100 asset management partners, insurance companies, and tens of millions of brick-and-mortar merchants. This breadth and scale across the financial service spectrum has enabled Ant Financial to build a captive and engaged user base. Eight in 10 of their users use more than two categories of services.

To transition to a payment platform, mobile operators will need to confront a number of challenges.

- First, operators will need to ensure a world-class onboarding experience for third parties. As outlined above, providing plug-and-play access to the mobile money service through APIs and open and modular IT solutions is a crucial step. But creating an environment that attracts third parties is not just a technical question: it spans the business to include legal contracting, enterprise customer support, and an ability to adapt to the needs of different types of third parties. In short, it requires a shift in strategy.

Making life easy for potential partners will also require industry-wide initiatives. This is already underway, as exemplified by adoption of the GSMA Mobile Money API, which streamlines and standardises the way third parties connect to mobile money. The GSMA Mobile Money Certification, which articulates a vision of excellence in mobile money consumer protection, can also help third parties to ensure their consumers are enjoying industry-leading risk management practices.

- Second, mobile money providers will need to make the most of their data to inform services and support third parties. Most platforms use data analytics to better understand their user’s’ needs in order to (a) reduce the risk of offering unprofitable services, (b) increase existing revenue sources by maximising sales and (c) add new revenue streams by offering suitable new services and products to the users.

Getting this right requires serious investment in data tools (collection, storage and analysis) and in talented staff to leverage them. In the case of mobile operators, combining data insights from the core GSM business and the mobile money business will be critical in creating a rich user profile base. The above will also require regulatory models that promote the responsible commercial use of mobile money data.

- Third, providers must determine how to offer the benefits of a payment platform to a mass-market audience in countries where feature phones and USSD remain the dominant channels for accessing mobile money. This will mean moving at two speeds simultaneously, to ensure that the mobile money user interface and experience are optimised for both types of devices. Success in this respect will shape the services available to poor and remote communities, where mobile money is often the only digital means of transacting.

- Fourth, mobile money providers will need to enable third parties to directly embed their content or their own functionalities through the app. For instance, the app-within-app model of WeChat has enabled millions of lightweight apps, ranging from banks, media outlets, and fashion brands to hospitals, drug stores, car manufacturers, and internet startups, to offer new content and features within WeChat and to establish new relationships with WeChat users. Third parties are not typically able to implement the full catalogue of their services through the mobile money app, and their relationships with customers are mostly established outside of the mobile money interface. While providing this feature is currently only possible via smartphone apps, providers also need to determine how to offer these new means of building relationships via feature phones.

In our forthcoming publication, we will provide an overview of the key pillars that will enable the transition to the payments as a platform model.

Relevant Resources and Blogs

Thursday 21 February, 2019 | Blog | Building the financial ecosystem | English | Global | Mobile Money | Policy and regulation

Payments as a platform: The future of mobile money