This blog post was co-written with Gunnar Camner.

In May, my colleague Jennifer Frydrych wrote about ‘The rise of mobile wallet-to-wallet cross-border remittance services’, highlighting MNOs’ strategies to broaden their financial services offerings. While this represents a dynamic evolution in the service provider market, the underlying funds transfer infrastructure remains the same, which is often costly and slow. To learn more, Erin McCune from Glenbrook wrote a great blog post looking at the costs and mechanisms in the current world of international transfers.

There are many new companies and solutions that are bringing new perspectives to the remittance industry (worth US$529 billion in 2012 [1]) by addressing the issues of cost and speed that are prevalent today. Bitcoin has highlighted the potential benefits of a secure and decentralised architecture to transfer value, and there is an opportunity to take some of the same principles of Bitcoin without the volatility and apply them to international transfers.

A company called Ripple is an open-source Internet protocol for real-time funds transfer that focuses solely on improving the cross-border payment infrastructure. Ripple uses cryptography similar to the bitcoin blockchain – a distributed public ledger confirming all transactions in the network – which promises to reduce costs and time significantly.

How does Ripple work?

To provide the rails for real-time transactions, Ripple enables two main participants:

- Existing, regulated Financial Institutions (FIs) hold funds and issue balances on behalf of customers (e.g. banks, payment processors, money transmitters and mobile money providers) and;

- Market makers (e.g., hedge funds, currency trading desks) that provide liquidity (pre-fund settlement accounts) to fund currency corridors they want to trade in.

Ripple allows point-to-point transactions between participating FIs. Market makers provide liquidity for settlement and foreign currency exchange at different FIs of their choice by pre-funding an account at a receiving institution in order to enable an “instant” payment. This means that FIs see reduced capital costs and currency risks, and in exchange for this, market makers earn a currency exchange spread on each transaction by competing in an open marketplace for transactions, where Ripple’s pathfinding algorithm routes transactions via the best spread.

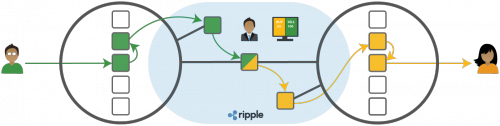

The example above (from the Ripple website) shows a cross-currency transaction between a sender and receiver, with Ripple facilitating settlement on the back-end. The man sends ‘green’ currency to the woman on the right who receives it in ‘yellow’ currency. The market maker in the middle has pre-funded yellow currency in the receiving FI that holds the woman’s accounts. The Ripple protocol then enables real-time funds transfer and settlement by executing two transactions:

- One transaction between the sender’s account to the market maker’s account at the sending FI (green arrows); and

- Another transaction between the market maker’s pre-funded account and the receiver’s account at receiving FI (yellow arrows).

The public ledger confirms and validates these transactions and ensures that there are no mid-point failures for the FIs and the market maker who are both certain that all transactions are trusted and no fraud or disputes will arise from the transaction.

What does this mean for mobile money services?

Since market makers post liquidity, mobile money providers can join the Ripple network to enable real-time transfers without extending credit or requiring reserves from originators, or having to partner with a third-party processor. The improvements in straight-through processing should reduce error handling costs and the open foreign exchange market place facilitated by the protocol should drive down forex rates.

In addition, it’s important to note that mobile money operators will need regulatory approval in their respective countries to enable cross-border transfers.

Conclusion

The Ripple protocol opens international remittance to new players, introducing new capabilities while increasing efficiencies, reducing costs and potentially driving down the price to the end customer due to increased competition. It will be interesting to follow uptake of Ripple among existing and new players in cross-border and cross-currency transactions over the next months.

[1] For latest data and analysis on migration and remittances, please visit http://www.worldbank.org/migration