After a challenging start, mobile money is taking off in Côte d’Ivoire. In June 2013, CelPaid, Moov, MTN, Orange, and Qash Services had together registered close to 5 million mobile money accounts, 35% of which are active. [1] It is quite an impressive number considering there are only 9.6m unique mobile subscribers in Côte d’Ivoire (the mobile market has 20.1m GSM connections and a high degree of multi-SIMing). [2] However, it is only recently that Ivoirians have started to adopt mobile money. In December 2011, three years after the launch of the country’s first mobile money service, there were just over 2 million registered accounts and 22% were active.

What external factors have driven the adoption of mobile money in Côte d’Ivoire? What tactics have mobile money operators employed to increase usage?

The story of mobile money in Côte d’Ivoire demonstrates that mobile money can be successful even in markets where it struggled initially, and that it is possible for a slow-growing mobile money service to become a sprinter. [3]

Background

At first glance, the opportunity for mobile money in Côte d’Ivoire seems huge. With a population of 19.8m and the highest GDP per capita in the region, it has one of the most dynamic economies in West Africa. [4] In addition, with only 10.7% of adults in Côte d’Ivoire having access to a formal financial institution [5], mobile money seems an obvious conduit to increase financial inclusion.

Early on, the Central Bank of West African States (BCEAO) realised that mobile money had the potential to significantly increase financial inclusion. In 2006, the BCEAO issued regulation on electronic money that qualified non-banks for an e-money issuer license. Under this regulation, an e-money issuer can be a bank (in partnership with an MNO) or a non-bank institution that has been granted a specific licence by the central bank.

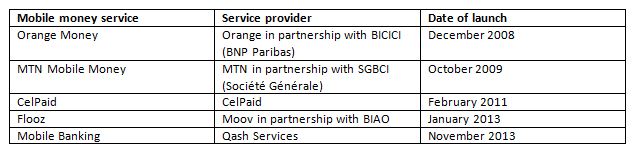

Since this regulation was issued, five companies launched their mobile money service in Côte d’Ivoire: Orange, MTN and Moov (the three leading MNOs in the country, licensed through their partner banks), and CelPaid and Qash Services (two non-bank e-money issuers).

It has taken time for mobile money to gain traction, but it seemed to reach a tipping point in mid-2012 when mobile wallet usage soared. What was behind this shift? Changes in market conditions following a period of civil strife, combined with new tactics by the leading providers to drive adoption. As Figure 2 illustrates, mobile money registrations have grown rapidly and today, over 40% of the adult population of the country has a mobile money account.

Table 1 – Mobile money services in Côte d’Ivoire

Changes in market conditions

The most obvious external factor driving the adoption of mobile money was the country’s return to civil peace and economic recovery in 2012. [7] A decade of political crisis culminated in 2010 when two candidates both claimed to have won the presidential election, triggering a national conflict that weakened the economy and left the population vulnerable.

In the course of one week in February 2011, four banks suspended operations, creating a major money shortage. [8] Public distrust of the financial system deepened, and was aimed at all types of financial service providers, including mobile money providers. The limited presence of banks, especially in rural areas, also made liquidity management more difficult and limited the ability of mobile money agents to provide cash-out services. However, a return to civil peace has helped to restart the economy. Mobile money providers in Côte d’Ivoire agree that the post-election crisis had a negative impact on their services and attribute the uptake of mobile money in 2012 in large part to the country’s economic recovery.

The uptake of mobile money in Côte d’Ivoire is not just the result of new-found stability, however. Over the last couple of years, mobile money providers have been using new and effective tactics to increase mobile money usage.

Focus on Orange Money

For Orange, one of the key factors driving success has been the commitment of its CEO. With the arrival of CEO Mamadou Bamba in 2010, mobile money became a strategic service for Orange. In June 2010, Orange Money was established as a separate business unit, with the head of the unit reporting directly to the CEO. The benefits of this new approach quickly became clear: the business unit sharpened the company’s focus on mobile money, which has proven to be an essential ingredient for success in other mobile money markets.

Orange also strengthened Orange Money’s brand image by partnering with established companies like the national water and electricity utilities to administer bill payments. It also invested in building a network of ATMs, which allowed customers to access cash at any time without the assistance of a mobile money agent. This further reinforced the image of Orange Money as a reliable and secure service.

“On many occasions, customers told us Orange Money changed their life. In fact the various partnerships and initiatives we engaged in are the results of our willingness to simply provide adequate answers to their needs”, Sadamoudou Kaba, Head Orange Money Business Unit at Orange Côte d’Ivoire.

Focus on MTN

MTN took a different approach, focusing its efforts on consolidating its distribution network. In early 2012, MTN decided to outsource the management of its distribution channel to Top Image, a field marketing agency with extensive experience in mobile money (having worked with mobile money providers like Safaricom in Kenya). Developing stronger recruitment criteria for agents, managing agent performance more closely, and increasing support for agent liquidity, all helped MTN to significantly increase its number of active agents. Very quickly, and without changing the commission structure, agent profitability multiplied four-fold. In the course of only a few months, agents became more motivated and provided better service to customers at the point of sale. With over 95% of its agents active on a 30-day basis, MTN Côte d’Ivoire now has one of the highest agent activity rates in the world.

“We started to make great progress in Ivory Coast as soon as we managed to put MTN Mobile Money distribution network in a virtuous circle, by supporting merchants enough so that they see profitability and growth. Should we put one pillar of the Mobile Money success in Ivory Coast before the others, it should be distribution as it remains our most important way to interact with our customers”, Jean-Michel Chanut, CMO MTN Côte d’Ivoire

Focus on Moov

Moov was the third MNO to launch a mobile money service in Côte d’Ivoire in January 2013. Moov is a subsidiary of Etisalat Group. While Etisalat had substantial experience in Financial services, Côte d’Ivoire was the first market were Etisalat Group subsidiary Moov rolled out Mobile Money service “Flooz”. Capitalizing on Etisalat experience accumulated from its international markets, as part of go-to-market activities, in Cote d’Ivoire, Etisalat paid special attention to the efficient merchants on-boarding and retail level activation activities.

“Of all the markets where we operate in West Africa, Côte d’Ivoire has demonstrated to be a very promising market for mobile money opportunities. There was a clear need for digitizing consumer finance services. Realizing the wealth of experience Etisalat Group gained from launching mCommerce offerings in other markets, we have decided to focus on SMEs and enterprise customers by developing the acceptance ecosystem ” – Khalifa Al Shamsi, Chief Digital Services Officer at Etisalat Group.

This case study of mobile money in Côte d’Ivoire was initially published as part of MMU 2013 State of the Industry report on Mobile Financial Services.

Notes:

[1] On a 90-day basis

[2] GSMA Intelligence

[3] Mobile Money Sprinters are the fastest growing mobile money services in the world as revealed by the 2012 GSMA Mobile Money Adoption Survey

[4] WorldBank

[6] Figure 1 – Number of mobile money users in Côte d’Ivoire. Source: MMU Intelligence

[7] “The State of Financial Inclusion in Ivory Coast in the Aftermath of the Crisis”, Microfinance Information Exchange (December 2013). Available at: http://www.themix.org/publications/mix-microfinance-world/2013/12/state-financial-inclusion-ivory-coast-aftermath-crisis

[8] “Ivory Coast’s Gbagbo seizes 4 international banks”, Bloomberg (18 February 2011). Available at http://www.businessweek.com/ap/financialnews/D9LF3DU80.htm

Top: Figure 1 – Number of mobile money users in Côte d’Ivoire [6]