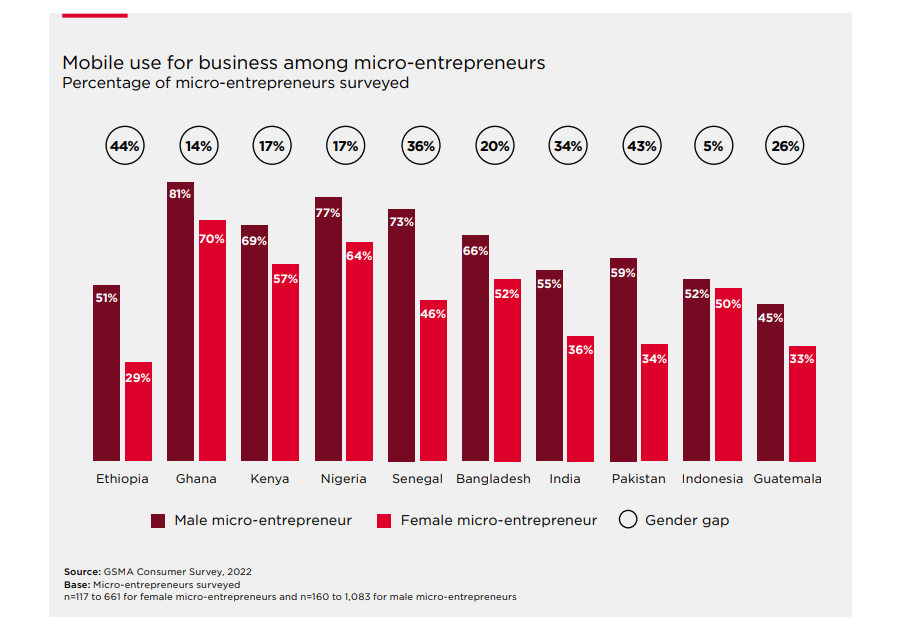

Women micro-entrepreneurs contribute significantly to the income and well-being of their families and the development of communities and national economies in low- and middle-income countries (LMICs). Mobile phones can be a source of economic and social empowerment for micro-entrepreneurs by providing access to information, services and resources that many would not be able to access easily otherwise, especially women. However, women micro-entrepreneurs face greater barriers than men to adopting and using mobile technology, meaning they are less likely to access and use a mobile phone to support their business (Figure 1). This might include calling customers or suppliers, receiving payments via mobile money, or using mobile internet to find ideas and inspiration.

Women micro-entrepreneurs are less likely than men to use a mobile phone for business, even when they own one

Our new research report ‘Understanding women micro-entrepreneurs’ use of mobile phones for business: Evidence from 10 low- and middle-income countries‘, demonstrates that women micro-entrepreneurs are less likely than male micro-entrepreneurs to own a phone, and use or be aware of mobile services, such as mobile internet, promoting their business via mobile, and digital financial services. In Pakistan, for example, women micro-entrepreneurs are 32% less likely than male micro-entrepreneurs to own a mobile phone and 36% less likely to use mobile internet.

Even when micro-entrepreneurs use a mobile for personal reasons, they are not always using it in their business. This is particularly true for women. In half of the countries surveyed, less than 50% of women micro-entrepreneurs who use a mobile for personal reasons also use it for business. Even when women do use mobile for business, they tend to use it for a narrower range of business activities, so are missing out on the full benefits.

Figure 1:

Communicating with customers and suppliers is the most common reason why women micro-entrepreneurs are using mobile phones

Our research highlights that when micro-entrepreneurs use a mobile phone for business, they mainly use it for the following five activities:

- Communication with customers, employees and suppliers

- Digital financial services, especially making and receiving payments

- Storing information and files

- Marketing, advertising or promoting their business

- Learning new skills or getting new ideas and inspiration

However, our research also finds that in most countries, usage of mobile for each of these activities is lower among women micro-entrepreneurs than their male counterparts.

By far the most common way micro-entrepreneurs use mobile in their businesses is to communicate with customers and suppliers. In mature mobile money markets, such as Kenya and Ghana, the use of digital financial services is also frequently reported, particularly sending and receiving payments. Use of mobile for other business activities is much lower.

Women micro-entrepreneurs face higher barriers than men to adopting and using mobile

Our research demonstrates that women and men micro-entrepreneurs experience similar barriers to starting to use a mobile for business, or using it more. However, women tend to feel these barriers more starkly due to restrictive social norms and structural inequalities.

Naturally, an initial barrier to using mobile for business is not having a mobile phone. This is a greater issue for women micro-entrepreneurs than men. In seven of the 10 survey countries, more than a quarter of female micro-entrepreneurs do not own a handset. This is the case for as many as 59% of female micro-entrepreneurs in Ethiopia and 51% in Pakistan. Among micro-entrepreneurs who already own a mobile phone, the key barriers preventing them from starting to use it for business or from using it more were:

- Not having the right kind of phone

- Preference for cash over digital transactions

- Lack of confidence or digital skills

- Safety and security concerns

Awareness emerged as another critical barrier, particularly among women. All micro-entrepreneurs in our survey were aware that a mobile phone can be used for communicating with customers and suppliers, but awareness of other ways a mobile could be used for business (e.g. for marketing products or learning skills) was significantly lower.

Increasing digital and financial inclusion for women micro-entrepreneurs requires multi-stakeholder action and collaboration

Unlocking the many opportunities of mobile technology for women micro-entrepreneurs has tremendous potential to not only empower women themselves, but also to shape more inclusive and resilient communities and economies. This will require targeted action by mobile operators and tech ecosystem players, governments, development practitioners and other stakeholders. Our report provides recommendations to enable women micro-entrepreneurs to reap the full benefits of mobile technology:

- Understand how women micro-entrepreneurs are using mobile for business, as well as their needs and barriers, to inform strategies and policies that will reach and support them with mobile.

- Increase awareness and understanding among women micro-entrepreneurs and their families of how mobile (including mobile internet and digital financial services) can be useful for their business and the potential benefits it can provide.

- Build the knowledge, confidence and digital skills of women micro-entrepreneurs to use mobile for business.

- Ensure women micro-entrepreneurs can access affordable handsets and data bundles.

- Design services that are relevant, reliable, easy to use, safe and affordable.

Read our latest report ‘Understanding women micro-entrepreneurs’ use of mobile phones for business: evidence from 10 low- and middle-income countries‘ for more detailed findings and recommendations. Research was conducted with approximately 8000 micro-entrepreneurs in 10 low- and middle-income countries (Bangladesh, Ethiopia, Ghana, Guatemala, India, Indonesia, Kenya, Nigeria, Pakistan and Senegal).

This research and work have been funded by the Bill & Melinda Gates Foundation, and in part by the UK Foreign, Commonwealth and Development Office (FCDO), and the Swedish International Development Cooperation Agency (SIDA).