The global spread of social media coupled with the rapid growth of e-commerce is giving rise to a new trend where content sharing, messaging and payments converge. Social commerce—the use of social interactions combined with the transactional nature of e-commerce—has led to new forms of shopping in collaborative online environments.

To better understand the social commerce opportunity and how mobile money providers might play a role, the GSMA commissioned a landscape analysis. Twenty social commerce players from seven countries were assessed to highlight their key features, value propositions for users (including customers and merchants), revenue sources and best practices.

The research paid particular attention to Chinese players. In 2017, e-commerce in China alone accounted for 84 per cent of all e-commerce in the East Asia Pacific region, and we expect to see social commerce soar in the same way. By 2020, social commerce is expected to amount to almost a third of China’s e-commerce market, with forecasted sales of $500 billion.

Our key findings:

- Social commerce boost businesses and benefits underserved customers. For small business owners and entrepreneurs, social commerce is a simple entry point to set up an online business and acquire an initial customer base, with minimal cost and complexity. This brings benefits to traditionally marginalized groups who gain access to relevant and affordable products and services. Over a third of social commerce providers specifically target women, rural or low-income individuals as their key market segment. For example, group buying platform Songshu Pinpin targets rural communities in China.

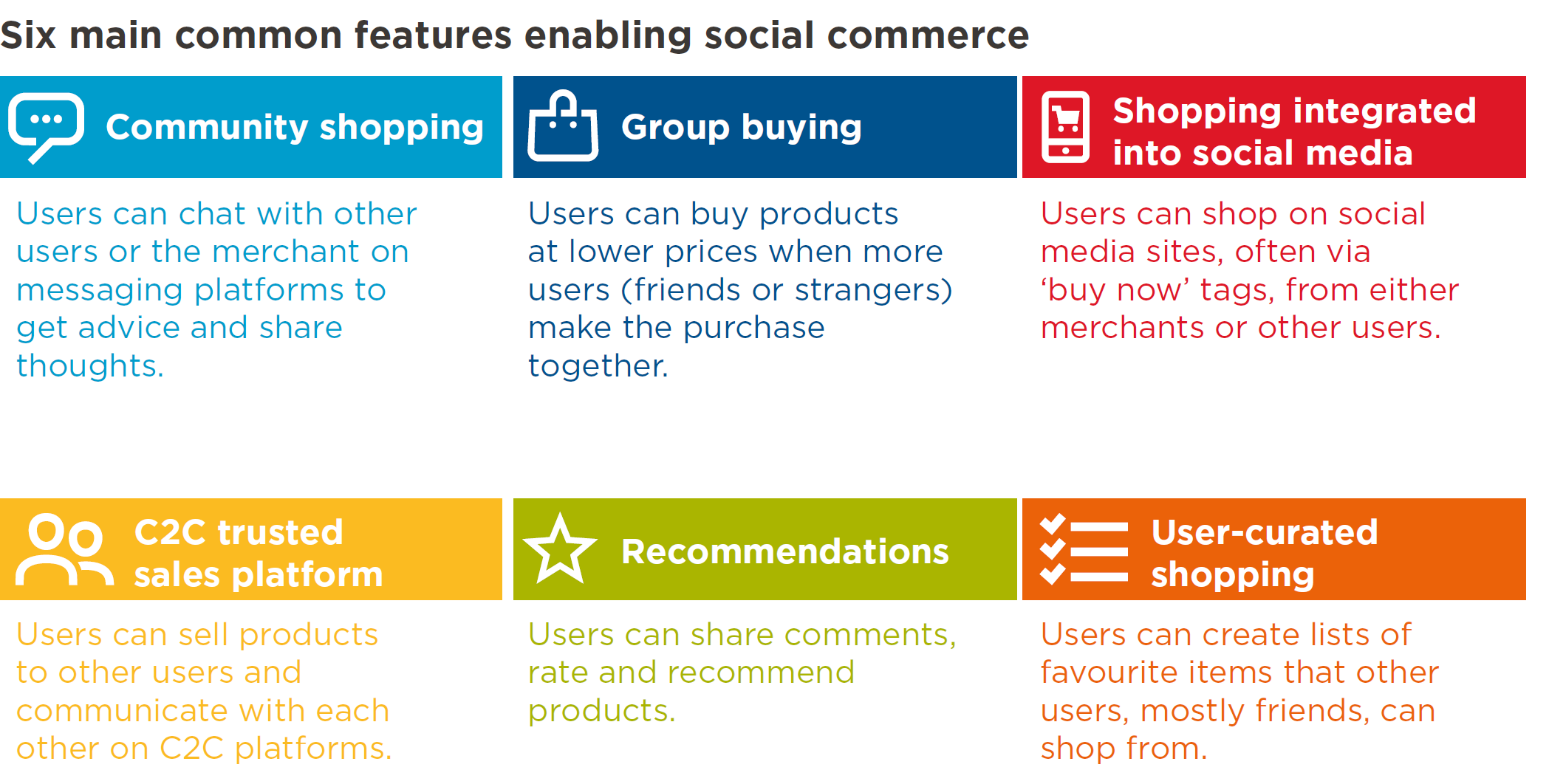

- There are six features common to successful platforms. While social commerce broadly encompasses any online shopping activity where e-commerce merges with social interaction, we identified six common features offered by platforms (usually two to three features per platform) – see the Figure below.

- Social commerce acts as either an e-commerce ‘intermediary’ or a ‘super app’ to varying degrees. In recent years, both traditional e-commerce and social media platforms have converged towards social commerce. Depending on their core focus, this has led to key differences in services. We identified six platform types depending on a player’s core focus.

- Marketing fees and sales commissions are the most common revenue sources. While there are four main revenue sources, most social commerce players leverage at least two. Players with a social focus are more likely to rely on marketing fees as a primary revenue source, while players with an e-commerce focus are more likely to leverage sales commissions. Some players also charge account fees or payment and logistic fees.

While social commerce offers many benefits to both merchants and customers, our landscape analysis revealed that some persistent challenges remain. In most markets, social commerce is not yet designed end-to-end. To address this, both merchants and customers try to eliminate existing frictions in their journey. These frictions lead to purchase journeys split between online and offline interactions or between different apps, informal delivery and payment processes, as well as concerns about trust. Therefore, there is a clear need for social messaging, commerce and payments seamlessly blending into one another to unlock the social commerce potential.

Mobile money providers can play several roles in social commerce and help with the sector’s future growth. They can either leverage their existing assets to address these frictions or offer new features and tools built in-house or through partnerships with third-party providers but must ensure they fully understand the market dynamics. Providers should develop one social commerce feature and over time integrate other features and tools. Similarly, providers should prioritise features based on their ease of implementation and the potential user impact in their market. Where feasible, providers can partner with third parties to quickly test and launch these solutions.

GSMA’s paper released today includes insights on the topic of social commerce and the role that mobile money providers can play in this space. The report is accompanied by a set of slides, which includes a detailed landscape of leading social commerce players that are most relevant to the industry.

As the ‘payments as a platform‘ approach takes flight, social commerce is an emerging opportunity for providers interested to cater to the evolving needs of individuals and small businesses. Are you considering to explore the social commerce opportunities further? The GSMA would be delighted to support you! Please get in touch with us at [email protected].

Receive the latest insights on mobile money straight to your inbox by subscribing below.