This blog and research have been co-authored by Dario Giuliani.

Since our first research on the topic in 2016, the tech ecosystems in emerging markets across Asia Pacific and Africa have significantly expanded. African tech start-ups alone have raised 53% more funding in 2017 compared to 2016, and in Asia Pacific, the financial capital injected in tech ventures made a 200% leap forward. Our new research carried out between January and March 2018, shows that the two regions are now hosting a thousand active tech hubs.

For clarity and consistency purposes, we have kept the definition of tech hubs that we adopted in 2016: “physical spaces designed to foster and support tech start-ups”. These include incubators, accelerators, co-working spaces, fab labs, makerspaces, hackerspaces, and other innovation centres.

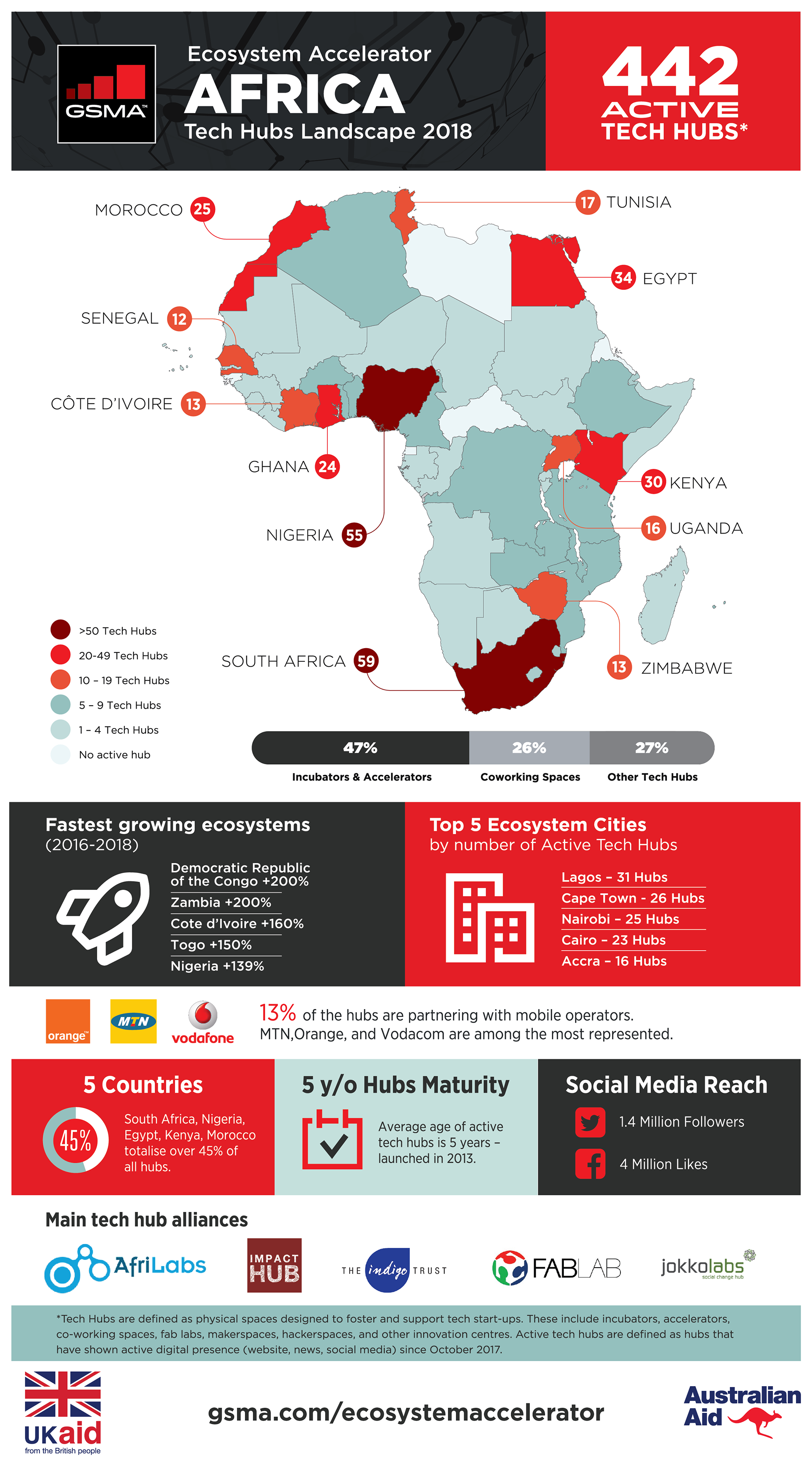

Download the Africa Infographic

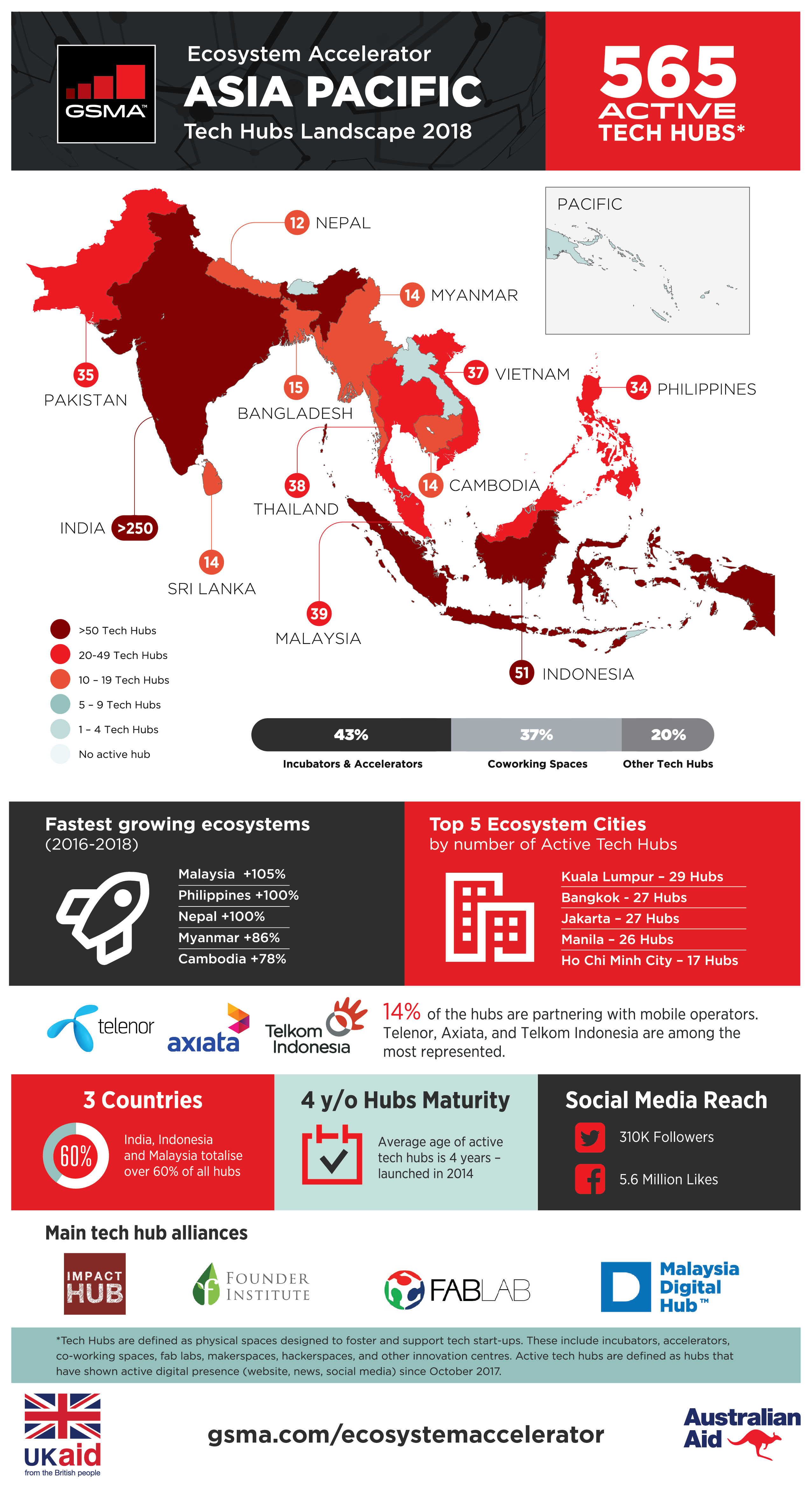

Download the Asia Pacific Infographic

The number of active tech hubs across emerging markets in Asia Pacific (excluding China) reaches 565 (+268 compared to our previous research), and 442 in Africa (+128). The leading country in Africa by number of hubs remains South Africa with 59 active hubs, followed by Nigeria (55), Egypt (33), and Kenya (31). Indonesia (51) – the largest market after India (circa 250), Malaysia (39), Thailand (38), and Vietnam (37) make up over 50% of the Asia Pacific tech hubs landscape.

Alongside the leading ecosystems (South Africa, Kenya, and Nigeria in Africa; India, Indonesia, Malaysia, Thailand, and Vietnam in Asia Pacific), ‘tier 2’ ecosystems have registered significant variations.

In Africa, countries like Ghana and Cote d’Ivoire, for instance, have experienced a significant growth in the number of active tech hubs over the past year. Since 2016, the Ghanaian ecosystem – home to hubs such as MEST and iSpace – has grown by 50% (from 16 to 24). Similarly, Abidjan in Cote d’Ivoire has gradually positioned itself as the new catalyst of innovation across Francophone Africa and has seen its number of active tech hubs double. Zimbabwe (13) and Uganda (16) led the way in ‘tier 2’ ecosystems in Southern and East Africa respectively.

In Asia Pacific, though still considerably behind Indonesia, the tech hub ecosystems in the Philippines, Cambodia and Myanmar doubled in size in less than two years, attracting regional programmes and global networks such as Impact Hub, which is now active in Phnom Penh, Yangon and Manila. Despite its smaller market, Nepal has been striving as a buzzing tech centre in Central South Asia with 13 active hubs.

More cities are emerging as regional innovative hubs. In Asia Pacific, Jakarta and Kuala Lumpur (27 active tech hubs each) are witnessing growing competition from cities such as Manila (26) and Ho Chi Minh (17). In Africa, Lagos has now taken over as the African city with the highest number of tech hubs (31) and potentially the leading innovation hub on the continent, especially after MEST, Google and Facebook announced the opening of local tech hubs between 2017 and 2018. Over the past two years, secondary ecosystem cities have also caught some light, denoting the growth of the national tech scenes outside of the main economic hub. Cities like Johannesburg, Kumasi, and Alexandria in Africa, and Hanoi, Penang, Ahmedabad, Bandung in Asia Pacific, are now established ecosystem cities in their respective markets.

Credit: MEST, Ghana

The last couple of years have also been characterised by the rise of tech giants’ interest in the untapped opportunities of African markets. CEOs including Mark Zuckerberg (Facebook), Sundar Pichai (Google), and Jack Ma (Alibaba) visited major hubs from Lagos to Nairobi, corporate partnerships mushroomed and players including Amazon and Alibaba increased their presence all across the continent. Before them, established mobile operators have been extending their footprint in the two regions by launching their own incubation, acceleration or co-working spaces and we observed that about 12% of the active hubs in either continent are now either run or backed by a local mobile operator. In Asia Pacific, Axiata, Telenor, and Telkom Indonesia have been significantly active in this space. MTN, Vodacom, and Orange appear as the most active operators in Africa when it comes to running or engaging with local tech hubs. A few recent examples in Africa include MTN in-house incubators “Y’ello Startups” launched in 2017 in Côte d’Ivoire and Congo. Asia Pacific, Jazz Xlr8r (Veon) in Pakistan and Digi Accelerate (Telenor) in Malaysia were among the most recent mobile operator-led tech hubs initiatives launched.

Credit: GP Accelerator – Grameenphone, Bangladesh

Both continents revealed a high degree of dynamism in the past eighteen months, as around eighty hubs have shut down across the two regions while more than 400 opened. Among the former, hubs such as the Ugandan The Space Hub have had to shut down, at least temporarily, while adjusting their business models. Similar instances include iLab in Liberia, JHub in South Sudan or the South African 88MPH, which froze its accelerator programme in 2015. The latter was among the first hubs pointing out that one-size-fits-all business models, no matter how widely tested, are not necessarily successful in such fragmented markets.

In this regard, a recent trend is the rise of industry-focused programmes run by large corporation such as the Nairobi-based Merck Accelerator, which supports health-tech ventures, ADB’s MATCh – Mekong AgriTech Challenge – active in Vietnam, Cambodia, Laos, and Myanmar, and the Bangkok-based Ayudhya Allianz Activator, which is trying to boost the InsurTech market in Southeast Asia. Similarly, a growing number of tech hubs are now devoted to financial technology services. These include Barclays’ Rise in Cape Town and Yes Fintech in Mumbai. Some organisations are even focusing only on blockchain technologies (e.g. BitHub in Kenya and Satoshi Studios in India).

The increasing preference for flexible business models for start-up support, investment and the reconfiguration of the working space have produced a global spike in co-working spaces and incubation programmes which is not expected to slow down in the near future. As to the rise of incubators and accelerators, the high uncertainty of one-size-fits-all programmes has led to the rethinking and reshaping of business strategies and models according to targeted market structures and industries.

After building a portfolio of 24 start-ups over the past two years, the GSMA Ecosystem Accelerator programme has launched the third round of its innovation fund on the 12th of March 2018 and is currently accepting applications from start-ups in Asia Pacific and Africa. Our support package includes non-equity funding, mobile-focused mentoring and technical assistance, and the facilitation of relationships with mobile operators. We are working closely with leading local tech hubs, which we believe are best positioned and equipped to identify and support start-ups locally.

The Ecosystem Accelerator programme is supported by the UK Department for International Development (DFID), the Australian Government, the GSMA and its members.