This is the first blog in a series that deep dives into our framework to help mobile operators close the gender gap in their customer base. The first step in this framework, and the focus of this blog, is the need for operators to “Understand the gap”: know where the gender gap is in their customer base, and why. Doing so will help reveal which of the five ‘themes’ – Accessibility, Affordability, Usability and skills, Safety and security, and Relevance – are most important for them to focus on in their individual market context, and provide insights into how to address the most common mobile-related barriers that women experience. Whilst a holistic approach is required, these five themes are key and will be the focus of the remaining five blogs in this series.

Why understand the gap?

Our experience working across Africa, Asia and Latin America has revealed vast differences in the degree to which mobile operators understand the gender gap in their own customer base. Although establishing a customer’s gender can often be challenging for operators, particularly in societies where men tend to purchase mobiles and services for their wives and daughters, doing so can reveal important insights into how women use mobiles differently to men, and opportunity areas for commercial gain and to more readily meet the needs of female customers.

How can data be used to reach more female customers?

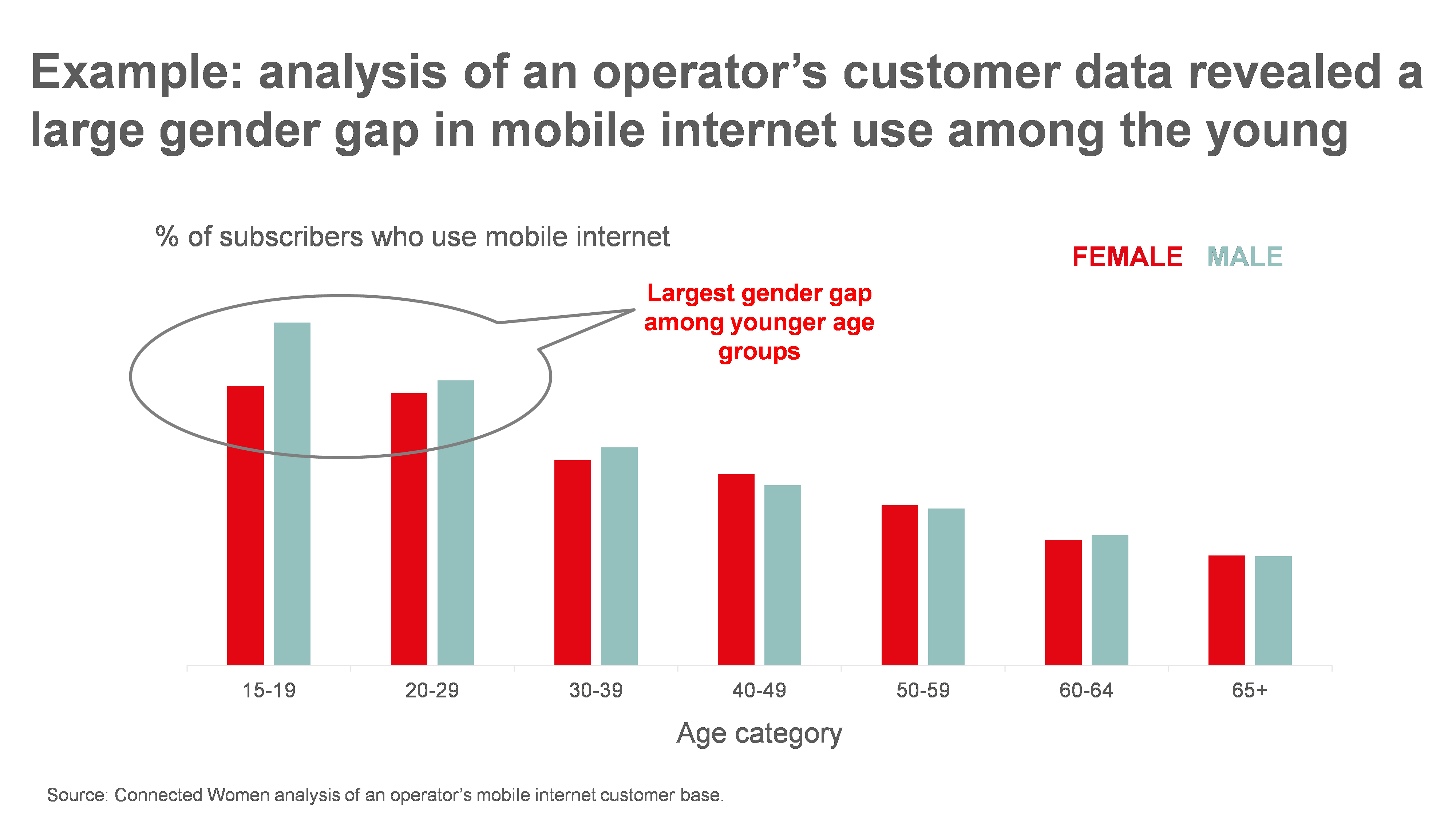

Understanding the mobile gender gap is not just about operators knowing what proportion of their customer base are women, but more detailed insights, such as is the gender gap in rural or urban areas? Is it larger for certain age groups, or income categories? Is it wider at a certain stage in the customer journey to adopting and using a product? How does women’s mobile usage differ to men’s? For example, if we consider mobile internet, is the largest gender gap at the stage where customers decide whether or not to purchase data for the first time, or is the largest gender gap at a later stage of the journey among customers who use high volumes of data? Do women use mobile internet differently to men, e.g. social media, video-calling or the information they seek?

Many of these questions relating to where the gender gap is can be answered by operators analysing the internal data that they already have (e.g. Figure 1).

Figure 1

However, field research can also be very helpful, particularly for understanding why the gender gap is where it is. For example, a combination of mobile money operator data analysis and complimentary field research in Cote d’Ivoire and Mali revealed that the most important gender gaps to address were at registration stage and among more advanced users, due to reasons including women’s lack of access to handsets, poor understanding of the service and perceived lack of need. A similar approach in Rwanda – analysing both operator data and field research – prompted Tigo to decide to launch an initiative to recruit female agents, resulting in an increase in the proportion of women in Tigo’s mobile money customer base.

Establishing the gender of customers: issues and solutions

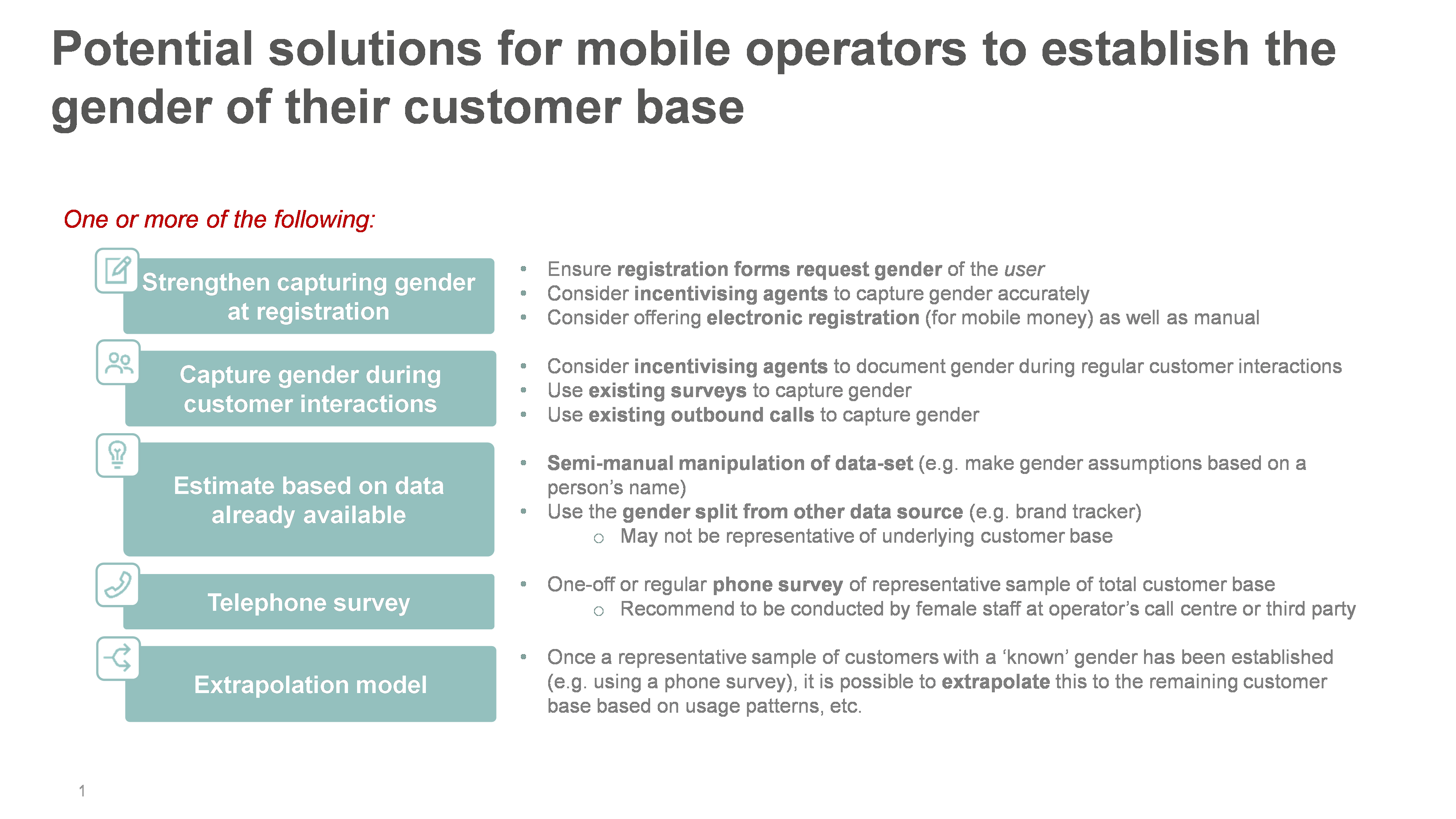

The first step for mobile operators seeking to understand the gender gap in their customer base is to ascertain which customers are men vs. women. Unfortunately, this data is not always available – customers may not be asked their gender at the point of registration or chose not to disclose it, agents may not consistently enforce operator registration requirements, physical registration forms may not be digitised on a central system, or gender may be available in electronic form but may not sync with other datatsets (e.g. SIM registration and mobile money data may be on different systems).

Even when gender data is available, it can be inaccurate, due to human error or the phenomenon of men purchasing SIMs and registering for mobile services on behalf of their wives and daughters, which is common in many countries. In Bangladesh, for instance, 78% of Robi’s female subscribers were registered in the KYC as male.

Fortunately, there are a number of actions operators can take to improve the availability and accuracy of their gender data, ranging from the ‘quick wins’ to the more sophisticated modelling approaches (Figure 2).

Figure 2

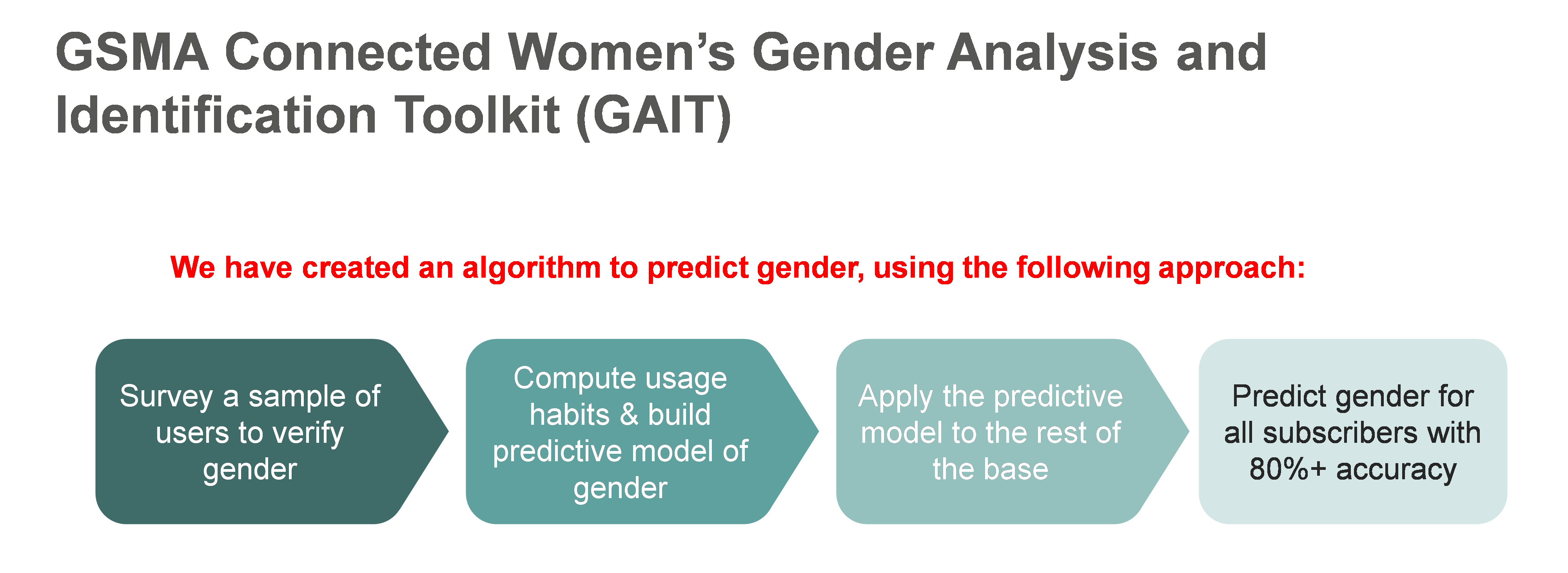

One example of the latter is our Gender Analysis and Identification Toolkit (GAIT), which uses machine learning to estimate the gender of unknown customers based on the usage patterns of a sub-sample of customers with a known gender (Figure 3).

Figure 3

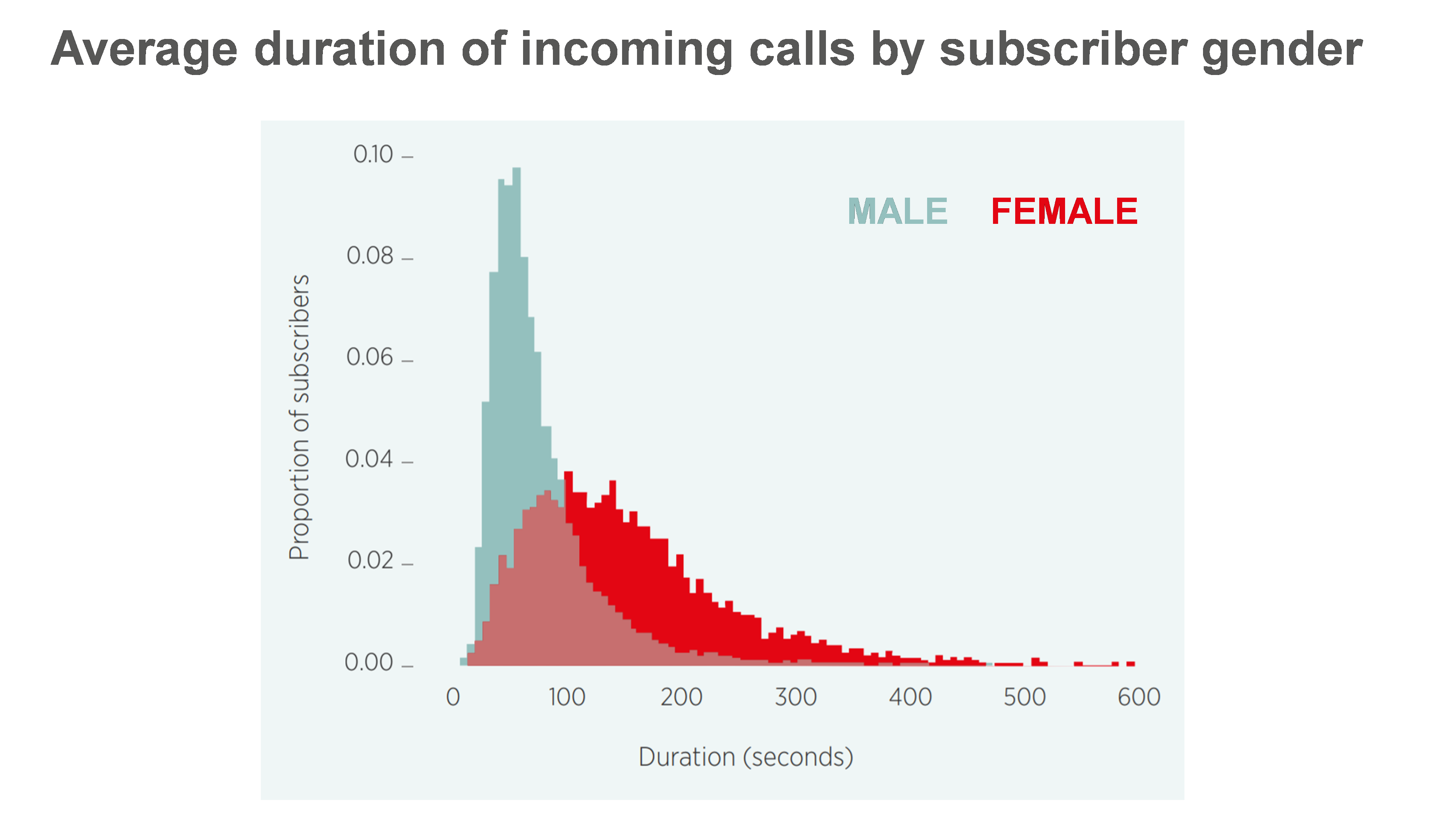

When GAIT was applied to Robi Bangladesh’s customer base, the gender of customers was predicted with over 80% accuracy, and subsequent analysis revealed interesting differences and opportunity areas in how male and female customers used their mobiles. For instance, in this particular context, the average incoming call duration for female customers was much longer than for male customers (Figure 4).

Figure 4

Next steps in the framework

Understanding the gap (i.e. knowing where the gender gap is in their customer base, and why) will help operators know where to target efforts and identify the most important barriers preventing women from owning and using mobile phones in their market. This will then help inform them which of the five ‘themes’ are most important for them to prioritise in their product/service design and marketing/distribution activities, which will be the focus of the five remaining blogs in this series: Accessibility, Affordability, Usability and skills, Safety and security, and Relevance.