The GSMA Digital Utilities programme hosted a webinar with industry stakeholders to discuss the shared value of pay-as-you-go (PAYG) solar for consumers, mobile operators and service providers. We also shared insights from our new report on the impact of PAYG solar on the mobile usage of consumers in Benin and Côte d’Ivoire. In this blog, we share some key take-aways from the webinar and discuss the opportunities for innovative partnerships.

From PAYG solar to PAYG everything – GOGLA’s overview of the evolution of the sector

In his opening remarks, Koen Peters, the Executive Director of GOGLA, the global association of the off-grid solar energy industry, took the opportunity to reflect on how the PAYG business model has evolved over time.

Beginning 2010, the off-grid lighting sector saw massive growth propelled by the emergence of solar products that utilised LED lighting technology. A few years later, companies such as MKOPA, Lumos and Mobisol (later acquired by Engie), would start providing PAYG-enabled solar home systems (SHS). The PAYG business model allowed the unbanked, with no previous credit track record, to access financing options for assets that were previously considered unattainable. Additionally, as customers built a credit history through their loan repayment, companies began bundling the SHS with other assets such as TVs, radios, and fans. With the off-grid sector maturing, companies have started specialising in different parts of the value chain such as production, distribution, and consumer financing, while offering a wider range of products such as smartphones, water pumps, refrigerators and cookstoves.

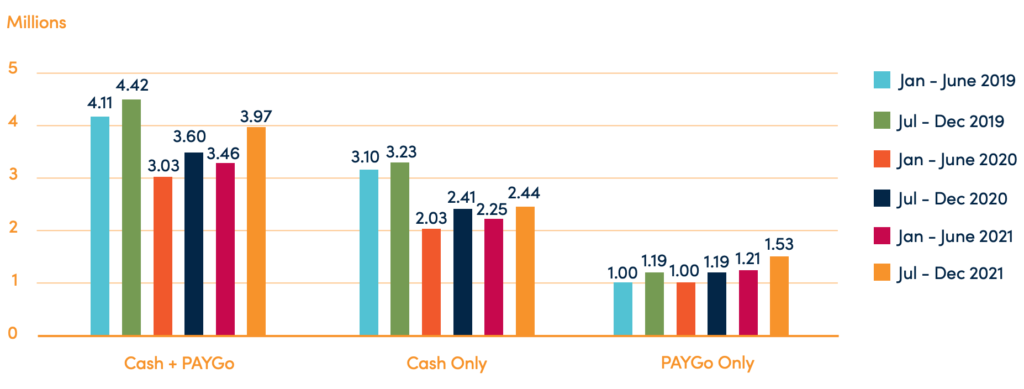

Peters also noted that while most sales for pico-solar and SHS are cash-based, there has been a consistent growth in PAYG sales. This signifies an opportunity for the PAYG sector to impact the over 600 million people across the world expected to still be without electricity in 2030.

Semi-annual Evolution of Volume of Lighting Products Sold – World

Trends in the off-grid solar sector

When the GSMA began awarding grants for PAYG solar in 2013, annual investment in the sector was $20 million per year. This has since risen to more than $300 million per year, between 2017 and 2020. In 2021, this amount rose by about 50 per cent, to reach $450 million, with debt investments rising as a proportion of investment. However, Peters also pointed out that about 90 per cent of these investments went to the top 10 companies in the market and more funding is required to support small and nascent service providers.

He also stressed that as companies are vertically disintegrating, creating further opportunities for partnerships across off-grid sector stakeholders. GOGLA also sees an increase in public funding going into demand-side subsidy programmes for SHS as governments and electrification agencies recognise the value of digital solutions and public- private partnerships. GOGLA has designed the End User Subsidy Lab to enable stakeholders generate and exchange knowledge and jointly design smart and effective end-user subsidies. In a previous blog series, the GSMA explored the role of these subsidy programmes in Togo as well as the lessons to be learned, and what such partnerships meant for other utility services.

The panel’s reflections on the evolution of PAYG partnerships

We were lucky to have exceptional panellists from ENGIE Access Africa, GOGLA, MTN Uganda and Widenergy who brought our research to life by sharing their extensive experiences working in, and with, PAYG solar companies. Our discussion provided evidence to the significant value of PAYG solar to mobile operators and highlighted the need for service providers and operators to work together to leverage the synergies across the solar customer journey.

The conversation was kicked off by Beatrice Mawemuko, Manager Strategic Partnerships and Business Development, MTN Uganda, who confirmed our previous research by running an analysis comparing data from their PAYG and non-PAYG customers. PAYG customers were associated with a 53 per cent increase in revenue volume across all mobile services, and a 44 per cent increase in mobile operator revenue. What was surprising for MTN Uganda was the over 100 per cent increase in data usage. Beatrice attributed this to the trend of bundling smartphones with SHS, and the strategic partnerships between the mobile operator and SHS providers. MTN Uganda continues to provide incentives such as data cost subsidies and zero-rating for customers who access smartphones through PAYG.

Gillian-Alexandre Huart, the CEO of ENGIE Access Africa, a clean energy product and service provider operating in nine African countries, shared ENGIE’s recent experience in PAYG solar partnerships. The number of mobile transactions for PAYG products has increased by 34 per cent year on year for the past two years, reaching about 27 million transactions in 2021, signifying the steady rise of PAYG on the continent. For ENGIE, customer centricity is key and partnerships with MNOs have enabled them to respond to their customers’ needs effectively, especially on payment issues. Moreover, their network of 6,000 agents, which include mobile money agents, has streamlined their customer journey from the initial point of awareness about SHS until usage. Huart stressed that they would like to see deeper partnerships between mobile operators and PAYG solar providers, moving past payments, and collaborating in activities such as marketing and product awareness. Part of our research identified what stages in the customer journey have the most impact in changing mobile usage, and through our insights, such partnerships can be strategically tailored to maximise impact and potential returns. Peters emphasised that such customer research is not only essential to grasp customer journeys, but also to articulate the sector’s broader impact and social returns to donors, governments, and investors.

Liliane Ndananeze, CEO of Widenergy, a last mile distributor of SHS and other solar products in Zambia, and a GSMA Innovation Fund grantee, shared her view on MNO-start-up partnerships. She encouraged both mobile operators and PAYG providers to work closely to leverage the myriad of synergies that exist. SHS customers, who were once unconnected to any source of power, rely on these SHS to charge their phones, which in turn increase their mobile usage. Similairly to Huart, Ndananeze also noted that partnerships with mobile operators need to move beyond just API integration.

How can these partnerships be fostered?

Reflecting on how to foster further collaboration between mobile operators and PAYG providers, Mawemuko from MTN Uganda closed the session by advising start-ups to approach mobile operators with a business plan that is aligned with the operator’s strategy. This should allow easier integration into the operator’s processes. Moreover, start-ups should be agile and always ready to adapt and deliver their solutions quickly. Lastly, solutions presented to MNOs should not only be impactful but also innovative, profitable, and scalable.

We would like to offer our sincere thanks to the panellists and attendees for joining this session and we look forward to our continued collaboration and further conversations in the future. The GSMA Digital Utilities programme looks forward to continuing our research on the sector and fostering successful collaborations among different stakeholders.

The Digital Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.