Following its launch in February 2023, the GSMA received a total of 593 applications for the GSMA Innovation Fund for Climate Resilience and Adaptation 2.0. The Fund was designed to help accelerate the testing, adoption and scalability of digital innovations that enable the world’s most vulnerable populations to adapt to, anticipate and absorb the negative impacts of climate change, or strengthen biodiversity. Building on the success of the previous round of grants, the Fund specifically sought applications from underexplored sectors and solutions.

With this in mind, the GSMA, with funding from the UK Foreign, Commonwealth & Development Office (FCDO) and the Swedish International Development Cooperation Agency (Sida), invited pitches from start-ups offering:

- Mobile and digital solutions which improve climate resilience and adaptation, focusing on vulnerable populations and ecosystems based in coastal areas, small islands, or urban settings

- Mobile and digital solutions tackling challenges posed by increasingly frequent extreme weather events such as extreme drought, flooding, high winds, wildfire and higher risks of land slips and erosion (excluding early warning systems)

- Nature-based solutions such as regenerative agriculture, sustainable forestry, and biodiversity strengthening which use mobile and digital technologies

- Mobile and digital solutions focused on sustainable consumption and production, such as reduced food loss and waste, improving sustainability and biodiversity of fisheries, and managing air pollution.

We reviewed all pitches, assessing them for creative and innovative ideas that could: bring meaningful change to the lives of communities vulnerable to climate change, generate sustainable revenue and scale-up, leverage partnerships with mobile network operators (MNOs), and harness the power of mobile and digital technology as an integral part of the solution. Other considerations included under-explored areas of climate action where use of digital tech is less evidenced, female-founded and women-centric solutions, and the commercial viability of the solution and stability of the start-up.

So how did these pitches for innovative climate tech measure up? This blog presents an analysis of key trends from the applications for the GSMA Innovation Fund for Climate Resilience and Adaptation 2.0, and expands on analysis of emerging trends within climate tech innovation from the first round of this Fund.

1. Rural farmers were the most popular user group for digital start-ups

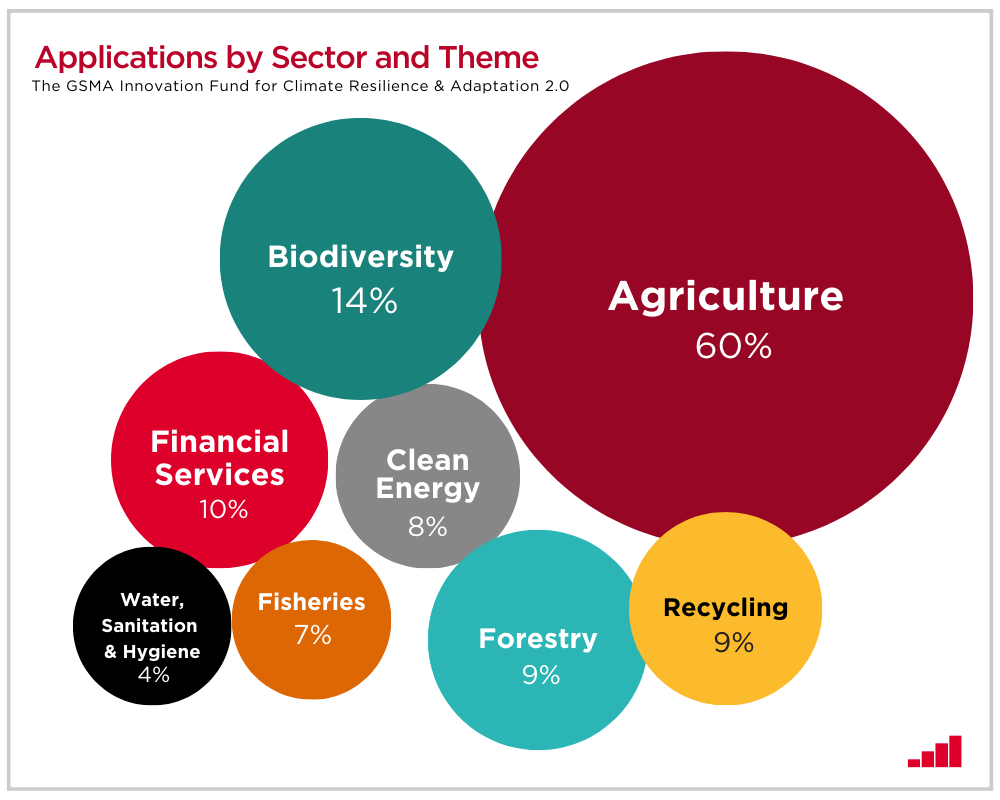

Agricultural solutions dominated the pool of applications, with 60% of projects focusing on this sector, particularly in North, East and West Africa, and South Asia as shown in Figure 1. This ranged from projects that offered climate-smart agricultural services to improve efficiencies, to weather forecasting or credit and insurance to help absorb the risks of climate shocks and stressors. Consequently, smallholder farmers in rural areas were the most common target user group across the projects submitted. This points towards start-ups being aware of both the tried and tested initiatives, as well as new opportunities for business within this sector, signalling a gap or need for more investment and opportunities in other sectors.

Figure 1

2. High representation of locally led innovation, particularly from Africa

We encouraged pitches from local entrepreneurs and homegrown talent and found that 90% of solutions were designed and delivered locally. This is a positive trend as locally led adaptation solutions are critical to sustainable climate resilience building. We received more applications from some countries and regions than others, as show below.

Figure 2

71% of the projects were from Africa and 25% from Asia. Less than 4% of solutions were from the Latin America and the Caribbean region, and other small island states in the pacific region. The countries from which we received the most number of applications from were Kenya (98), Nigeria (65), Pakistan (39), Uganda (38), and India (29).

Among solutions not locally led, 72% were presented by companies headquartered in the Global North, while 28% were proposed by companies from the Global South intending to implement in a neighbouring country. This could indicate a limited number of transnational climate-tech start-ups in the Global South – or that climate tech startups in the region have yet to expand beyond their domestic markets.

3. Start-ups are combining the use of multiple innovative technologies

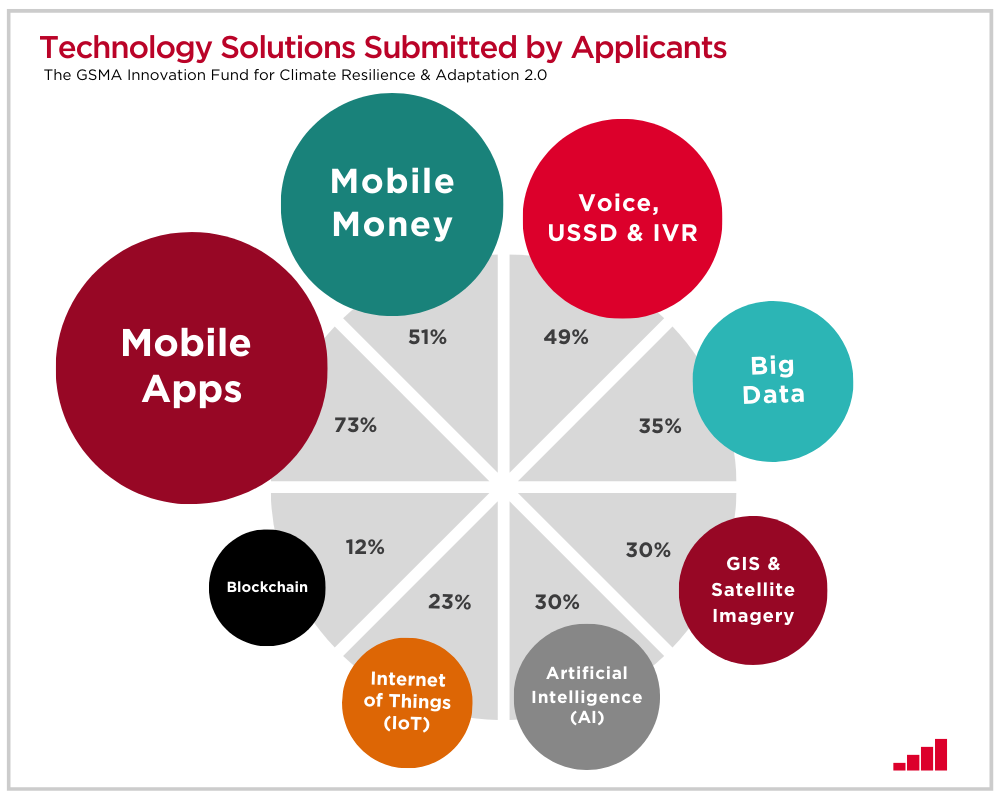

Most start-ups pitched solutions which use a combination of technologies as part of their projects. Almost three-quarters (73%) of all pitches involved a mobile application, highlighting the widespread use and accessibility, convenience, monetisation opportunities, and rapid development and deployment of mobile apps. Many of the pitches referenced use of trending technology ‘buzzwords’ without explanation of how it will be used and the status of development. For example, although 40% of applicants claimed to use blockchain in their solution, GSMA analysis found that only 12% of pitches provided sufficient details of how and demonstrated the actual implementation of blockchain as an integral part of their solution.

Figure 3

At a regional level, more start-ups in Africa pitched using mobile money (59%) compared to 30% in Asia, and 39% of start-ups in Asia pitches using artificial intelligence compared to 26% in Africa, reflecting the divergent regional advancements and market demand for these technologies. These regional differences align with application trends from the first funding round.

4. Growing momentum for female entrepreneurs driving solutions that target women

Of the start-ups that pitched to us, 56% had at least one female member on their executive board or were female founded, compared with less than half from the previous round of applications. This is a positive trend, as women and girls are disproportionately impacted by climate change, and it is critical to have female leaders and thinkers designing targeted solutions that address the needs and build the resilience of women and girls.

A third (33%) of the start-ups that applied designed either all, or a particular component, of their mobile and digital solution to specifically target women in communities vulnerable to the impacts of climate change. Less than half (42%) of start-ups were targeting both women and men equally, while only 13% of start-ups did not have a specific focus on women with their solution.

5. Limited understanding of how to measure and evidence social and environmental impact

Applicants were required to detail their strategies for assessing and measuring the impact of their projects. Few start-ups had incorporated data collection mechanisms, such as feedback logs on a mobile app, directly into their solutions for monitoring and tracking impact. Many of the proposed plans by start-ups on how to measure and demonstrate their impact on the environment or biodiversity were either too high-level to effectively capture project successes or too resource-intensive, making them impractical for early-stage companies to allocate funds and staffing towards. Among the start-ups targeting women, only 48% were able to explain how they would measure and evidence the results and impact of their project on women.

This underscores a monitoring and evaluation technical skills gap. By investing in their capacity to measure and evidence impact, start-ups can showcase their influence and share valuable insights with the sector more effectively. This is essential for attracting additional investment and funding. It will also help them to integrate monitoring systems into the solution itself, rather than having to create additional processes and systems to do so.

6. Challenges in articulating pathways to scalability and sustainability of pitched solutions

Communicating business plans with sustainable business models can be a significant challenge for start-ups, as investors scrutinise the details of the numbers behind the ideas to ensure that there is revenue to be generated and profits to be made.

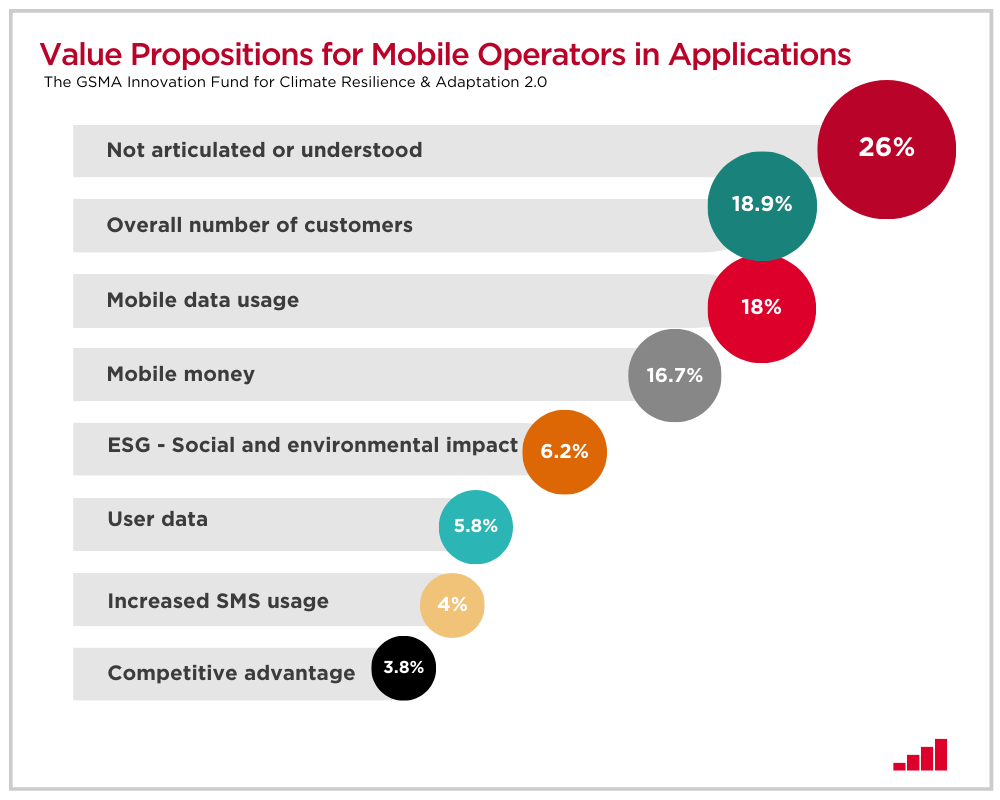

Most start-ups were able to explain a high-level business approach and target customer base, with 73% of pitches using a Business-to-Consumer (B2C) model and 61% with a Business-to-Business (B2B) model. However, many struggled to expand on their business model details beyond identification of their customer base, or give a clear explanation on how they plan to scale-up their solutions in the long-term. They also faced difficulties in articulating what value their mobile and digital solutions could bring to MNOs to leverage a partnership (see Figure 4 below).

Figure 4

More than a quarter of applicants (26%) failed to articulate how a partnership with a mobile network operator might be mutually beneficial. From the remaining, most start-ups suggested that their mobile or digital solution would bring value to such a partnership by either helping to increase overall numbers of customers (19%), increasing mobile data usage (18%), or increasing mobile money usage (17%).

Applicants that provided clear responses to questions on their pathway to sustainability referenced growing the user base in the domestic and/or regional market, adding to their product and service offerings, or venturing into selling carbon credits to generate additional revenue. Many earlier stage start-ups also listed continued grant funding as another pathway to sustainability, highlighting the different interpretations of the question.

Looking forward

From the 593 pitches, our Fund Panel of sector experts selected an exceptional cohort of start-ups to be awarded a grant through the GSMA Innovation Fund for Climate Resilience and Adaptation 2.0. The unveiling of the new cohort of grantees is right around the corner, and we’re thrilled to share the exciting news at MWC Barcelona 2024 – watch this space for more information!