This is the fourth in a series of blog posts that provide a deep-dive into different mobile money services who proved to be successful in increasing the mobile money penetration amongst women in their respective markets. This blog series complements the report, ‘Reaching half of the market: women and mobile money’. This blog post was co-written by Claire Scharwatt.

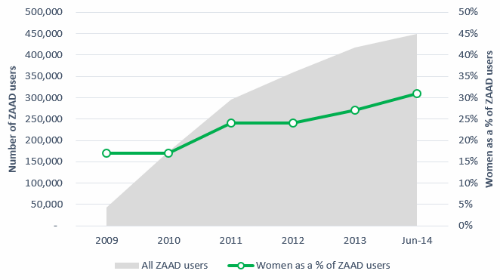

Launched in June 2009, Telesom ZAAD was the first mobile money service in Somaliland, and was identified as a mobile money sprinters in 2012. As of June 2014, they had 450,000 registered users, 31% of which are women. The percentage of women in ZAAD’s customer base has increased from 17% in June 2010. If we consider that over 70% of the country’s population is illiterate and 98%[1] is financially excluded, ZAAD’s mobile money penetration, particularly among women, is remarkable.

In this context, how did Telesom manage to almost double the penetration of its service among women? In this blog post, we explore some of the tactics that were employed by Telesom and discuss their impact.

Adoption of Telesom ZAAD by women (June 2009 – June 2014)

Women are key to the success of mobile money in Somaliland

With no formal banking infrastructure in place, financial inclusion remains a major challenge in Somaliland, where the yearly per capita income ranges between USD 250 and USD 350.[2] While ZAAD was largely designed as a customer retention tool, Telesom’s bigger ambition was to provide basic financial services to the unbanked population of Somaliland.

From the beginning, Telesom ZAAD’s main focus has been salary payments and merchant payments, with a clear objective to create a mobile money service that did not require customers to repeatedly cash-in and cash-out, but instead encourage them to keep money in their accounts and transact digitally.[3] Telesom’s senior management quickly recognised that increasing the penetration of ZAAD among women was key to the success of the service. Indeed, men are typically the breadwinners while women are the household financial managers in this market. This typical household structure is what prompted Telesom to target women.

As Abdirahman Shire, the ZAAD Services Manager of Telesom, explains, “Initially, we wanted to attract more female customers because they are the household’s financial managers. Salary payment over mobile money is very popular. However, men typically tend to send their salary to their wife, who then manages this money. Telesom wanted to attract more female customers so that men could send their salary to their wife over mobile money, instead of cashing it out to give it in cash. This way, money stays in the system instead of being cashed out.”

Increasing the number of women who have mobile money accounts means that operators can convert these cash-outs into P2P transfers, thereby digitizing more financial transactions.With this in mind, Telesom implemented a number of tactics designed to help them increase the penetration of ZAAD among women.

Recruiting female agents allowed Telesom to register more female customers

One of the first tactics Telesom employed was to hire female staff to drive the registration of female customers. Somaliland is a primarily Muslim region, and a significant number of women wear the niqab and are not willing to remove their veil in front of men. However, as part of the KYC requirement to register to the mobile money service, customers are required to have a picture taken by a Telesom agent.[4] To address this challenge and ensure that more women would register for the service, Telesom recruited female agents across their main branches in the major cities of Somaliland.

Research[5] has shown that female agents not only tend to attract more female customers, but that they also tend to offer a superior customer service to both men and women. Also, female agents are found to be more reliable by customers, compared to male agents. Through this recruitment, Telesom noticed an increase in the number of women who were visiting branches for ZAAD, and also in the number of women registering for the service.

A targeted ATL marketing approach helped Telesom raise awareness of ZAAD among women

Telesom developed above-the-line (ATL) campaigns to increase awareness of the service and its use cases amongst women. TV and radio advertisements depicted women using ZAAD, with an emphasis on merchant payments and savings, to showcase the convenience of the mobile money service. Telesom’s ATL strategy was combined with below-the-line (BTL) activities on the ground, particularly in rural areas, in addition to bulk SMS campaigns targeting women to increase awareness of the service.

Images from one of Telesom’s TV advertisements for ZAAD

Telesom also developed an IVR (interactive voice response) solution to complement access to ZAAD on USSD and facilitate access to the service for illiterate customers, many of which are women. However, the success of this tactic remains unclear.

Data analysis provided more detailed understanding of women’s usage patterns

Finally, Telesom’s team started to analyse mobile money usage data through a gender lens. This allowed Telesom to understand the usage patterns of women versus men. Specifically, Telesom found that:

- While the majority of ZAAD female users are active, their average active rate is lower than that for male users (59% compared to 79% respectively);

- Active female users tend to make fewer transactions than men on a monthly basis – female users averaged 38 transactions, compared to the average 52 for men;

- The most popular transaction types among female users are bill payments, merchant payments and airtime top-ups;

- Women tend to store less money on the mobile money account than men. In fact, the average balance for women is 45% lower than the average balance for men.

Realising that there is still room for growth within their female customer base, Telesom recently hired a consultant to help them identify solutions to continue to increase the traction of ZAAD among women. Going forward, we will continue to support Telesom’s team and to share their progress on reducing the gender gap among their mobile money customer base.

To find out more on what operators can do to increase mobile money penetration among women, read our report “Reaching half of the market: women and mobile money”. The MMU and Connected Women teams will continue to gather insights on this topic, so please get in touch to share your stories and insights, either by posting comments below or by emailing the authors of the report: [email protected] and [email protected]

[1] ‘Hello GSMA Mobile Money Sprinters! Telesom Zaad, Telenor Easypaisa, UBL Omni, Orange Money announced as fast growing mobile money services’, GSMA MMU, 2013

[2] “Somaliland in Figures”, Ministry of National Planning and Development of Somaliland (2012)

[3] To find out more about ZAAD, see Claire Pénicaud Scharwatt and Fionán McGrath, “Innovative inclusion: How Telesom ZAAD brought mobile money to Somaliland” (2013)

[4] It is worth noting that unlike most mobile money services, Telesom does not use agents outside of their branches, so the people who are in charge of customer registration, cash-in and cash-out are regular staff of the operator.

[5] ‘Dialog’s 5 Star Partner Programme – Integrating women into the rural retail chain’, GSMA Connected Women,