This article is part of the Spectrum Policy Trends 2024 report. Download the full report for a handy compilation of the top six spectrum policy trends for 2024.

Some countries in the mid-to late-2010s considered single wholesale networks (SWN) as a novel policy concept that might help provide greater mobile coverage. These government-initiated monopolies are now fading as a trend and do not boast a single successful implementation anywhere in the world. Policymakers considered SWNs instead of relying on competing mobile networks to deliver mobile broadband services in 4G or 5G, but 2023 saw such monopolies abandoned for competitive market approaches.

Why does it matter?

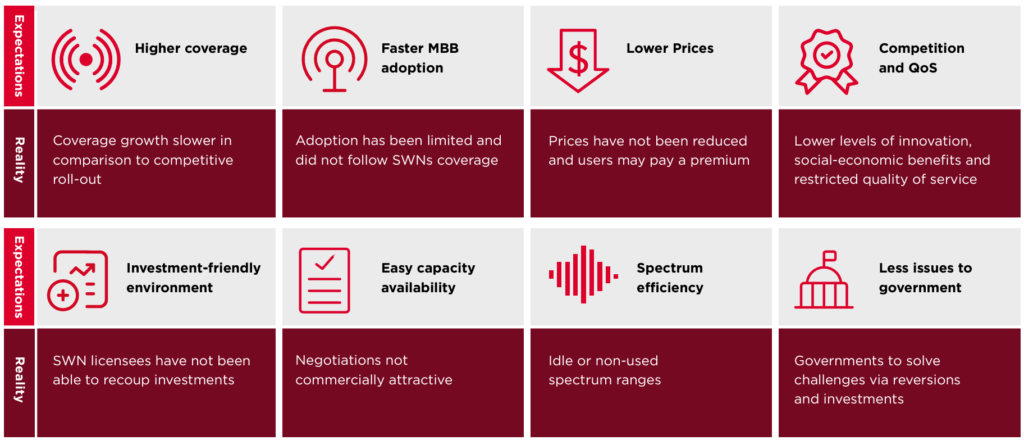

Supporters of SWNs argued that they would improve connectivity better than the traditional model of network competition in some markets. The hope was that they would address concerns including inadequate competition or lack of coverage in rural areas, inefficient use of radio spectrum, or fears that the private sector may lack incentives to maximise coverage or investment. However, SWNs have not delivered those promises anywhere in the world.

Why are regulators and governments changing their views on SWNs?

Two of the most important reasons are the lack of take-up of their services and the fact that coverage improvements have been slower compared to competitive rollouts. SWNs are government-backed monopolies and, as such, tend to encourage high consumer prices, which has resulted in low adoption. Other shortcomings illustrated by real-world use cases include SWN licensees that have been unable to recoup investments and increased government involvement. Altogether, the results of nearly all SWN programmes have been idle spectrum, lower levels of innovation, limited socioeconomic benefits, and restricted quality of service.

Figure 1: SWNs – expectations vs reality

What are the policy considerations?

All governments should carefully consider their approach to increase the quality and reach of next-generation mobile broadband. The GSMA recommends that governments, regulators, and mobile operators collaborate on long-term solutions that help address both coverage and usage gaps, taking into consideration that:

- Affordable access to low-band spectrum promotes mobile coverage and increases capacity.

- Setting out a robust spectrum roadmap allows long-term planning and minimises OpEx.

- Technology neutrality and spectrum refarming deliver efficiency.

- Voluntary infrastructure sharing will support wider coverage.

- Voluntary spectrum leasing or trading helps maximise efficiency.

- Elimination of sector-specific taxation delivers growth.

- Resilient assignment processes help streamline planning.

- Streamlining of Quality-of-Service requirements will support roll-outs.

The coverage gap, or the proportion of any population that lives outside of mobile coverage, is decreasing and stands at around 5% globally. Meanwhile, the usage gap, the percentage of people living within mobile coverage but not accessing mobile broadband, stands at 40% globally but is higher in middle-income countries. Spectrum policies can directly impact lowering the usage gap by encouraging the quality and affordability of mobile services.

What we expect to see in the year ahead

In 2024, we expect a further demise of the SWN approach. Instead, policymakers will rely on network competition to deliver mobile network coverage and broadband adoption, bolstered by supportive government policies. In areas where building networks is not economically viable, we will see innovative approaches, including voluntary network and infrastructure sharing, technology-neutrality and spectrum refarming.

Enabling competition and encouraging private sector investment are proven methods of developing connectivity in underserved areas. The growth of mobile broadband, and with it, the social and economic development of the world, will depend on collaboration rather than intervention.

| Policy Good Practice: UK’s Non-Spot Network The UK’s Shared Rural Network (SRN) project is a non-mandated joint operator and government initiative designed to improve mobile coverage in rural areas of the UK. The project’s overall objective is to increase total 4G coverage to 95% by 2026. To deliver the programme, EE (BT), Vodafone, O2, and Three UK will invest £532m to eliminate the majority of ‘partial not-spots’ –areas that receive coverage from at least one but not all operators. The UK Government will provide a further £500m to build new masts to eliminate ‘total not-spots’–hard-to-reach areas with no coverage. This was a collaborative solution, put together through commercial agreements between the mobile operators and has proved far more successful than the monopoly wholesale approach of SWNs. The UK example, rather than a government monopoly, is a single, commercially shared network focusing solely on areas where competitive networks are not commercially viable. |