This article is part of the Spectrum Policy Trends 2024 report. Download the full report for a handy compilation of the top six spectrum policy trends for 2024.

The digitisation of industry has significantly impacted the spectrum strategies of some countries already, with regulators choosing to limit macro-cell spectrum in favour of more capacity for local or standalone private networks. However, while regulator-enforced sharing mechanisms and spectrum carve-outs have been considered imperative in some countries, they have been deemed unnecessary in others as less intrusive measures are implemented to facilitate bespoke industry networks.

Best practice regulation for private mobile networks (PMNs) is still being developed, and the coming years will clarify which approach brings the greatest positive impact to society.

Why does it matter?

While private mobile networks do not necessarily require 5G NR technologies, as many rely on LTE, the 5G era has provided a new wave of digital transformation and a fresh business opportunity for the mobile ecosystem. Private mobile networks and massive IoT can play a role in delivering productivity growth while offering one of the core business opportunities of the 5G era. However, nearly six years after the first 5G launches, private networks still represent new ground in terms of regulatory best practice.

Figure 1: The addressable market and revenue opportunities for 5G private networks

What are the policy considerations?

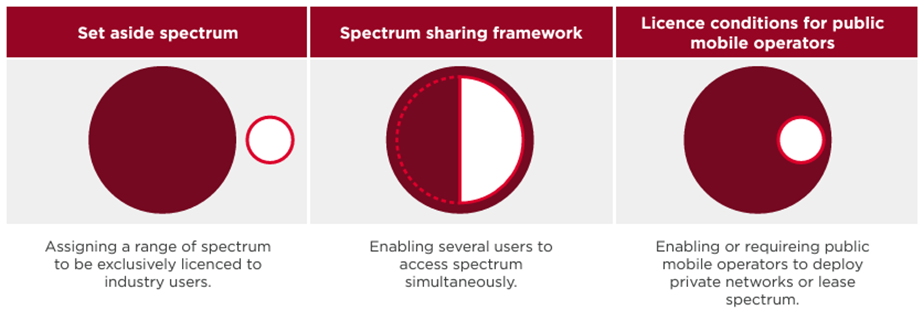

Regulators have taken different approaches to meet the interest in private mobile networks, which typically fall into one of the three categories outlined below.

Figure 2: Approaches for providing spectrum to private networks for industry users

Making spectrum available for industry users can be done through public mobile operators, enforced sharing approaches, or exclusive set-asides. Needs must be balanced against demand from other users. As a result, the benefits regulators expect from assigning mobile spectrum to private or local networks must be carefully weighed against the cost of potentially denying other users access to the same resources.

Set-asides create spectrum scarcity and raise prices for enterprises and consumers. Meanwhile, mobile operators have the ability to create customised networks to meet enterprises’ specific needs through public spectrum without a set-aside. However, regulators may feel that carving out spectrum through regulatory-enforced sharing mechanisms or spectrum set-asides can enhance competition and bring value to their markets.

There is evidence that:

- Set-asides create spectrum scarcity, raising the price of spectrum to operators and impacting investment and positive consumer outcomes.

- Spectrum sharing frameworks have a negative impact on the value of spectrum.

- Well-designed licence conditions for mobile are the least intrusive mechanism for delivering private mobile networks.

What to expect in the year ahead

A deeper and more granular analysis of regulatory practices for set-asides will begin to shape government thinking in the next year. There has been ongoing debate on set-aside spectrum for PMNs versus offering services through the public spectrum of operators, with mixed opinions globally. Early examples of set-asides came from countries with sizeable high-tech industry sectors in their economies, and setting aside spectrum for private or local networks has been assumed to facilitate their use in these countries. However, there is no evidence that the correlation between set-asides and PMN growth in such countries implies that the growth was caused by the set-aside itself rather than their large high-tech industrial sectors.

There has also been an increase in the number of partnerships between operators and enterprises/ecosystem players to deploy private networks. Operators have the advantage of using their diverse spectrum and network resources to design virtual network slices that can provide tailored connections for private networks rather than one general-purpose connection. Depending on the requirements, demonstrating a range of solutions to offer customised services to PMNs can also be an advantage.

GSMA Intelligence research shows that most operators should offer private 5G networks by 2025. As momentum accelerates, we expect to see more partnerships between telcos and other ecosystem players in 2024 to provide end-to-end private wireless solutions to enterprises.

We also expect to see a better data-based understanding of the impact set-asides have on PMN growth and their negative impact on public mobile.

| Policy good practice: Finland delivers PMNs without carve-out As part of a policy to promote Finland as a 5G innovator and testbed, licence conditions in the 3500 MHz mobile spectrum auction in 2018 fostered the provision of private network services without a dedicated set-aside. The licence conditions stipulate that mobile operators must, where requested by tender, deploy a private network that meets the specified customer needs in a localised area, such as a hospital, port, or industrial facility. Operators can charge reasonable, non-discriminatory fees for these deployments. Alternatively, if they consider the tender requirements overly onerous, they must sub-licence 3500 MHz spectrum within the specified area instead. Finnish operators are among the world leaders in 5G deployment. Telia had infrastructure ready ahead of the auction in September 2018, allowing it to launch a pre-commercial network in November 2018. All three operators launched 5G services in 2019 and expanded network coverage throughout the coming years. Telia then launched 5G Standalone in November 2021, making it one of the first operators to do so in Europe. Finland has seen successful and innovative cooperation between industry and mobile operators. |