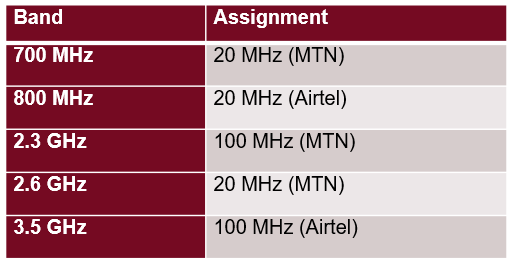

In June 2023, the Uganda Communications Commission (UCC) successfully awarded spectrum to two of the country’s mobile operators, MTN and Airtel, in the crucial 700 MHz, 800 MHz, 2.3 GHz, 2.6 GHz, and 3.5 GHz bands, reaching at least 100 MHz per operator in mid-bands for 5G. Five operators participated in the competitive multi-band award process (beauty contest), launched in May 2023.

These additional low- and mid-band ranges are key to deliver coverage for rural areas and enhance city-wide traffic capacity, respectively. The perfect recipe for the successful expansion of mobile broadband in 4G and 5G.

In Uganda, around 74% of the population live in rural areas, which is well above the average of 54% for Sub-Saharan Africa (SSA) – making it particularly challenging for MNOs to cover all parts of the country and even more important to have low bands available.

Due to its propagation characteristics, the 700 and 800 MHz bands are well suited to expand coverage in both densely and sparsely populated areas, as well as to improve quality of service (e.g., download speeds). Therefore, low bands not only unlock digital equality, but also allow operators to avoid network densification, supporting lower carbon emission targets.

On the mid-bands camp, while Uganda is yet to commercially launch 5G networks, access to the 2.3 GHz, 2.6 GHz and 3.5 GHz ranges paves the way to the revolution of 5G services and ensure complementary city-wide capacity for 4G in the near term.

A GSMA study shows that 2 GHz in mid-bands are needed by 2030 per market. While the point at which this figure is required will vary, UCC has further options to look at when trying to reach it as 5G matures. Progress on the 3.5 GHz range is promising, and other bands, such as 6 GHz, are also needed.

The reward for reaching the 2 GHz goal is substantial. 5G growth in SSA is expected to develop rapidly in the second half of the decade and continue into the 2030s. The economic impact of mid-band 5G will be around 0.4% of GDP in 2030 – higher as a percentage of GDP than in Europe and North America. The overall GDP impact (also in 2030) will be $13bn in SSA.

To leverage this opportunity, there is momentum in the region. Nigeria, Kenya and South Africa assigned spectrum in the 3.5 GHz range in 2022, and Senegal, Namibia and Mozambique have just finished or are expected to launch auctions in the upcoming months.

As investments matter, the final spectrum fees to be paid by the new licensees have shown to be reasonable. This perfectly fits the growing realisation among regulators and policymakers that affordable spectrum pricing is critical to unlocking the digital growth of nations, a position the UCC has continued to embrace.

Larger amounts of spectrum and lower spectrum prices are strongly linked to greater population coverage, better download speeds and increased service adoption, including via lower prices. On the other hand, in return for more reasonable prices, licence obligations demand coverage of networks and quality of services.

Coverage obligations: Population vs geographical

The new licenses also hold coverage obligations that are geographical, instead of population-based, with the aims to bridge the rural-urban gap. Currently, in Uganda, 77% of the population are covered by 3G and 31% by 4G, while 53% of the country’s geography are covered by 3G and 24% by 4G.

The coverage gap (citizens not covered by any mobile broadband signal) has been steadily declining. According to GSMA research, this stood at 9% as of 2021, representing a 23% reduction from 2017. On the other hand, broadband adoption is not keeping up with this trend, resulting in a high usage gap (citizens living within mobile broadband coverage, but not utilising it) of 69% as of 2021.

Addressing the main barriers to mobile broadband adoption, including affordability and digital skills, should be a priority for stakeholders to realise the potential of mobile connectivity to drive economic growth and development. Coverage obligations, therefore, need to factor in the urgency of addressing these barriers to increase the adoption of mobile services in Uganda.

Prioritising geographical coverage obligations can impose significant financial burdens on mobile network operators, impacting service affordability. Also, requiring geographical coverage obligations may divert resources away from areas where the demand for mobile services is higher and where a larger population can benefit from higher investments.

On the other hand, by focusing on population coverage, operators are encouraged to deploy in areas where people reside, work, and commute – the areas where service provision is needed. By concentrating on regions where more people can benefit from the services, operators can achieve economies of scale, optimise network performance, prioritise investments, and reduce costs.

As the primary means of internet connectivity in SSA, mobile is driving digital inclusion. This delivers significant economic benefits, reduces poverty and transforms lives by providing people access to various life-enhancing services. Careful consideration must be made when determining coverage obligations to ensure the sustainability and efficient utilisation of scarce resources to meet the most critical need in bridging the digital divide.

This recent assignment is a positive step towards reaching Uganda’s broadband targets of delivering internet access in all parts of the country. These targets are critical to advancing Uganda Vision 2040, which aims to transform Uganda into a modern and prosperous country by 2040. Harnessing the power of mobile technology will be critical to achieving this goal for a country with a population of nearly 50 million people, which is expected to double by 2050.