A clear spectrum roadmap for 5G, setting out forward-looking plans for spectrum supply and taking account of emerging spectrum needs, technological evolution and international developments, is essential.

While 5G networks are well-established in advanced Asia Pacific markets such as Australia, Japan and South Korea, the pace of 5G development differs significantly across the APAC region. Building on our report Roadmaps for 5G spectrum in the APAC region, the GSMA has taken a closer look at the state of 5G spectrum planning in three major markets in Southeast Asia – Indonesia, Thailand and Vietnam – and the key issues and challenges in securing sufficient spectrum resources.

Current situation in Indonesia, Thailand and Vietnam

The three countries are at different stages of their 5G journey:

- In Thailand, 5G is off to an encouraging start following the award of spectrum in the 700 MHz, 2600 MHz, and 26 GHz bands in early 2020. As of end-2021, 5G network coverage has reached 76% of the population and continues to grow.

- In Indonesia 5G is just beginning, with limited launches by operators using existing spectrum holdings, and

- In Vietnam commercial 5G services are not yet available. However, Viettel have carried out trials across several bands.

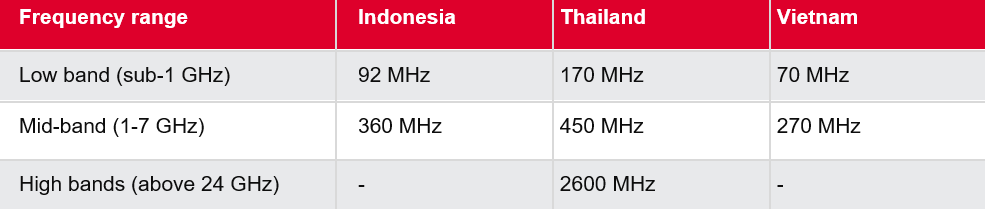

The differences are also reflected in the amount of spectrum assigned for IMT services in each of these markets as shown below.

Recommended action plan

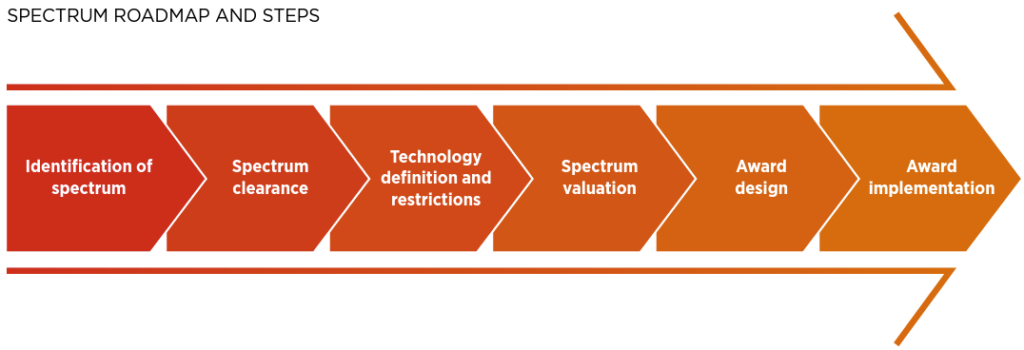

The roadmap for awarding spectrum for 5G consists of several important steps as shown below.

There are similarities in terms of challenges faced by policymakers and regulators in Indonesia, Thailand and Vietnam, for example, need to ensure there is adequate spectrum for 5G in the 3.5 GHz range. However, measures to address this issue differ. Usage in this band by incumbents (e.g., fixed satellite services), and the regulatory frameworks in place have to be taken into account. These considerations will also extend to other bands, including the planning of the analogue TV switch-off (ASO) the release of the 700 MHz band, as well as clearance of the 2.6 GHz band in Indonesia.

The valuation and pricing of spectrum is another crucial aspect. The rising cost of spectrum poses a major threat to the future development of mobile services. A considered, conservative approach to spectrum prices can help support future mobile broadband growth, encourage sustainable, long-term investment, and deliver maximum socio-economic benefits in the long run.

The 5G journey is only just beginning. Policymakers and regulators must take a longer-term view on the spectrum roadmap for 5G across the rest of this decade and beyond. This involves working towards making around 2 GHz of mid-band spectrum available for mobile by planning for 4.8 GHz and 6 GHz bands to support 5G expansion. More details on the status of 5G planning, the challenges faced, and recommended action plan can be found in our reports for Indonesia, Thailand, and Vietnam. You can also learn more by visiting the GSMA’s 5G spectrum guide.