This article is part of the Spectrum Policy Trends 2024 report. Download the full report for a handy compilation of the top six spectrum policy trends for 2024.

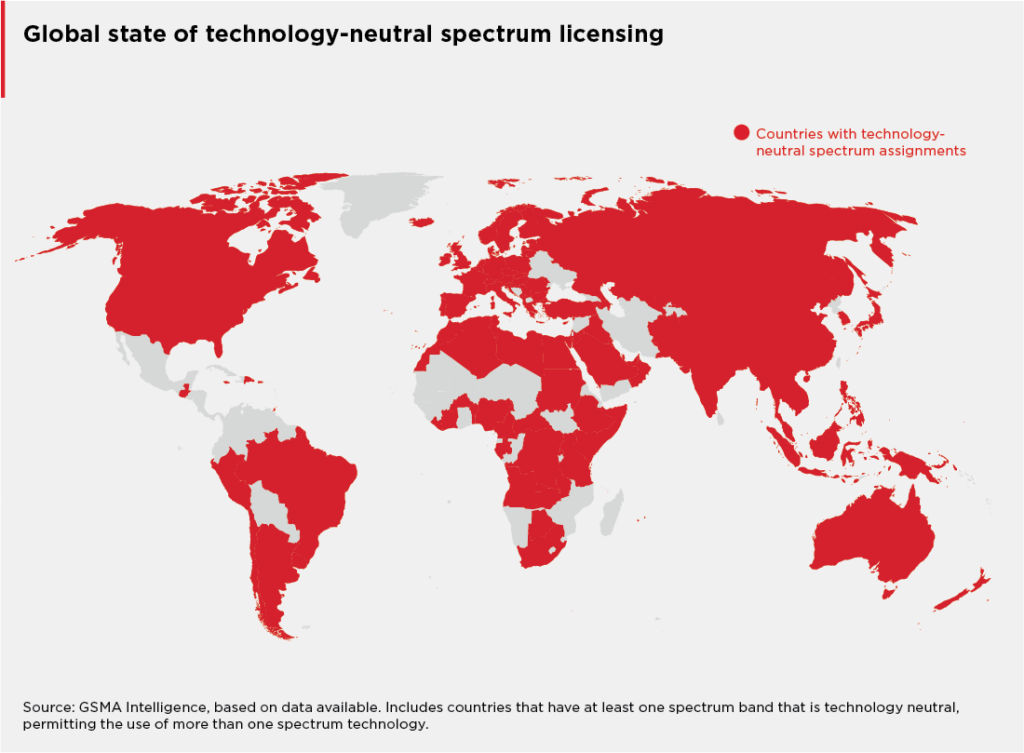

The need for additional spectrum to meet coverage and capacity expectations for 4G and 5G services is driving the refarming of spectrum from legacy technologies worldwide. Technology-neutral spectrum licensing is crucial to allow mobile operators to refarm spectrum used by legacy (2G and 3G) networks to 4G and 5G services at a pace driven by market demand.

Why does it matter?

Optimising spectrum licensing is a crucial success factor for countries that want to reap the rewards of mobile connectivity. That includes maximising the use of existing resources using tools such as technology-neutral spectrum.

Spectrum is a limited resource, making it a challenge to increase capacity in response to the growth in data traffic. In recent years, regulators and operators have been exploring the flexibility afforded by technology-neutral spectrum licensing frameworks and network sunsets to use spectrum resources more efficiently. Technology neutrality allows flexible approaches to spectrum management, such as enabling technology sunsets and allowing operators to phase out legacy networks and migrate spectrum resources to support new, higher quality, more spectrally-efficient technologies.

What are the policy considerations?

Spectrum licensing

By allowing mobile operators to upgrade their legacy networks to 4G and 5G, technology neutrality is an important enabler of economic growth, productivity and employment. According to GSMA Intelligence:

- Over the period 2000–2017, on average, a 10% increase in mobile adoption increased GDP by 1%.

- The economic impact of mobile increases by approximately 15% when connections are upgraded from one mobile network technology to another.

- By 2019, the benefits from the additional services and functionalities enabled by 4G upgrades contributed almost $390 billion (or 1% of income growth) to the $2.5 trillion of economic activity enabled by mobile technology.

This has important implications for the potential benefits of new generations of mobile technology, such as 4G and 5G, and highlights how technology-neutral spectrum licences not only enable efficient management of spectrum but also help unlock significant economic growth.

Additionally, by enabling technology neutrality in spectrum assignments, regulators can ensure a substantial reduction in carbon emissions, given the lower energy consumption of more efficient and newer mobile technologies. According to GSMA Intelligence report spectrum assignments that are not technology-neutral would force operators to rely on less energy-efficient 3G and 4G networks, while also slowing adoption of 5G.

Service neutrality

Service neutrality describes a regulatory approach where the license granted to a service provider does not specify a particular type of service and is necessary to unlock the potential of technology-neutral licensing. Where the latter exists but not the former, operators are still restricted in their ability to refarm their spectrum holdings for newer technologies and other types of service in a way that maximises the efficient use of spectrum and meets market demand for new services. Conversely, together, these approaches create a more flexible and competitive telecommunications environment that allows for graceful network sunsets.

Network sunsets

Legacy network sunsets are closely linked to technology-neutral licensing. The sunsetting of legacy networks describes the gradual phasing out of mobile infrastructure that supports devices running on previous technologies, such as 2G and 3G.

The motivation for legacy network sunsets varies, with factors including refarming spectrum for 4G/5G services, optimising network operations (with potential capex and opex savings), rationalising device portfolios and mitigating the risks associated with the maintenance of legacy equipment.

Market conditions, rather than government-issued mandates, should drive the process. This calls for close collaboration between regulators, mobile operators and other ecosystem players to identify and implement the enablers of a smooth phasing out of legacy networks.

What to expect in the year ahead

In 2024, sunsets are no longer a question of ‘if’, but ‘when’, emphasising the importance of a well-planned network sunset roadmap. According to GSMA Intelligence, 143 networks (2G and 3G) are scheduled to go offline globally between the end of 2023 and 2030, with around 50% of these planned by the end of 2024. Most of these networks operate primarily on 900, 1800 or 2100 MHz.

A growing number of regulators will create a service-neutral or unified licensing framework that allows operators to utilise technology-neutral spectrum licences to offer different mobile-based services, including FWA, using the most efficient networks and technologies. This means removing restrictions or requirements for a new licence, usually at an additional cost, and undue red tape, which can delay the introduction of new mobile services in response to market demand. Otherwise, countries considering tech neutrality can learn lessons from countries that have already implemented technology upgrades and are planning to retire legacy networks.

For operators, a sunset cycle (the time between starting to sunset the network and finally shutting down the last connection on the network) can range from two to five years, depending on how prepared they are. A well-planned network sunset roadmap should account for the transition of enterprise and consumer customers and a device upgrade strategy to support the availability of VoLTE roaming agreements to support 3G sunsets.

| Policy Good Practice: South Africa continues to exploit technology-neutral licensing The Independent Communications Authority of South Africa published three final Radio Frequency Spectrum Assignment Plans (RFSAPs) for International Mobile Telecommunications (IMT) Systems in April 2023. The three bands addressed in the RFSAPS – 450-470 (IMT-450), 825-830 and 870-875 MHz (IMT850), and 1427–1518 MHz – were earmarked to be auctioned on a technology-neutral basis, building on an existing technology-neutral licensing framework, to enable the rollout and uptake of 4G and 5G services across South Africa where mobile internet penetration is at 61.5% according to the GSMA Intelligence. |