This is the first of four blogs aimed at understanding the causes of low user activity rates in the mobile money industry and potential strategies on how to improve mobile money activity. This blog explores barriers to active account usage. The second blog explores what providers can do to boost usage.

Surpassing 1.35 billion accounts in 2021, mobile money has now established itself as the key to financial inclusion in low- and middle-income countries (LMICs). Of these, only 26% of accounts (346 million) are active on a monthly basis, while 38% (518 million) are active on a 90-day basis (Figure 1). As a result, despite significant growth in registered accounts, hundreds of millions of individuals globally are not yet reaping the full benefits of financial inclusion, along with the suite of use cases enabled by mobile money adoption.

Figure 1: Number of registered and active mobile money accounts, 2012-2021

While there has been progress in improving account activity rates, growing from 20% in 2012 to 26% in 2021, these can be much higher. So how can mobile money providers (MMPs) and other stakeholders drive active use among the remaining pool of one billion accounts that are less active or dormant? Overcoming this challenge first requires identifying its causes.

Low account activity at the provider or country levels may not always be symptomatic of low levels of financial inclusion. Causes may relate to a lack of need, due in part to the existence of viable alternatives such as a traditional bank account. In markets with high levels of mobile money penetration, some users may own multiple accounts but only use one of them on an active basis, resulting in low activity for their other account(s).

For all other causes which do hamper financial inclusion, account inactivity can be caused by both supply and demand-side issues. On the supply side, this includes unfavourable regulation, inadequate infrastructure, insufficient investment or inefficient corporate strategies. The demand side comprises a range of socio-economic factors: financial literacy, poverty, social norms or geographic isolation.

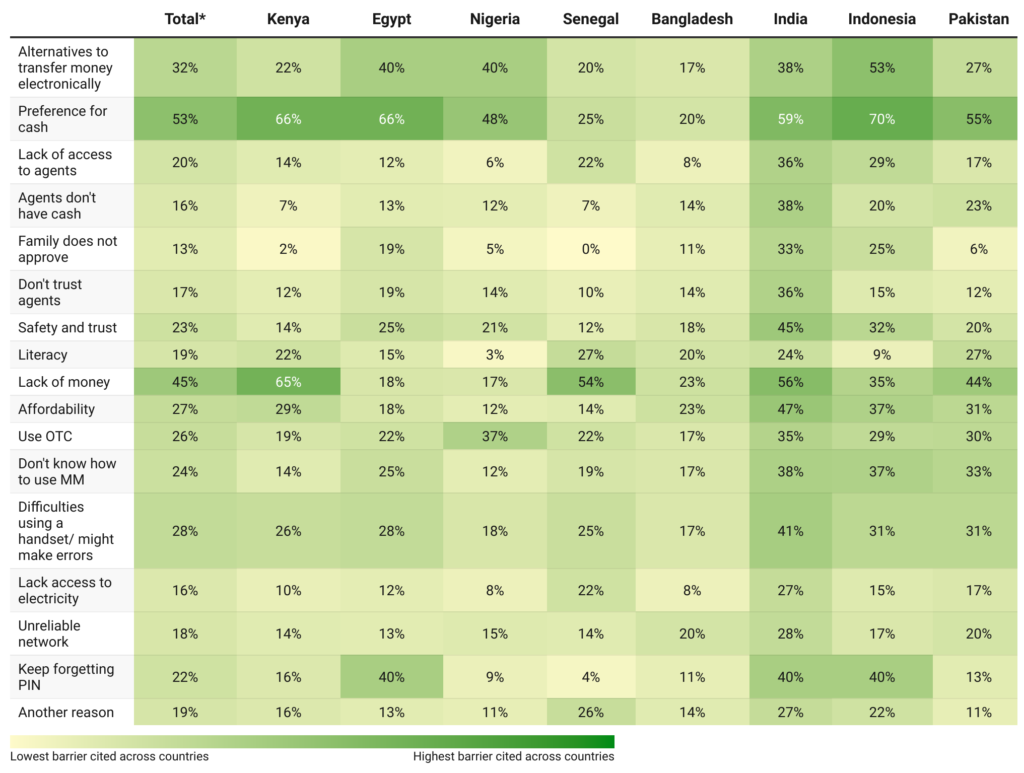

Findings from the annual GSMA Consumer Survey run in ten countries* in 2021 shed light on perceived reasons for low activity. Over 400 inactive account owners were asked to select between 17 possible reasons for low activity (Figure 2). The figure below summarises the responses received.

Figure 2: Summary of 2021 GSMA Consumer Survey responses

Though they vary significantly across markets, the main barriers include a preference for cash, lacking sufficient funds for mobile money to be useful and not needing mobile money due to alternative electronic financial services. Other important barriers include users having a limited ability in using a phone, mobile money transaction costs being too high, and a preference for making agent-led transactions (Over-The-Counter transactions).

A preference for cash was the main reason for not using mobile money actively – except in Bangladesh and Senegal. While the reasons for this preference may not be known, mobile money services should strive to bring increased utility to account owners continuously seeking a better understanding of their overall financial needs. In short, fulfilling user needs by facilitating day-to-day living, improving economic activity and weathering shocks.

Feedback from providers and consumers alike has suggested that a “preference for cash” is usually caused by addressable barriers, such as: the use of alternative money transfer services; a negative experience using mobile money (e.g. due to bugs, downtime or inadequate user interface/experience); or a lack of appropriate education about the product. Among others, these reasons all correspond to barriers we explore in the remainder of this blog, as well as subsequent blogs in this series. Further customer research in each market and at the provider level can help to better identify this.

A lack of money[2] was perceived as a key barrier to active use in India, Indonesia, Kenya, Pakistan and Senegal. Similarly, affordability (for example, due to the existence of transaction fees) was seen as a challenge to active use in India, Indonesia, Kenya and Pakistan. While these may in some cases constitute actual barriers in LMICs, notably due to high poverty levels, there are common misconceptions that transacting via mobile money is always more expensive than cash, or simply irrelevant/impossible when dealing with small transactions. For instance, users may not know that some types of transactions are free (e.g. on-network P2P transactions in some markets), or take into account opportunity costs such as travel time related to cash transactions.

The use of other electronic money transfer services was also quoted as a reason for low use (e.g., in Indonesia, Nigeria, Egypt, India and Pakistan). This includes the prevalent use of over-the-counter (OTC) services, as seen in collected responses.

Knowledge and skill-related barriers were prominent in several markets too. In India, Indonesia and Pakistan, respondents expressed a low ability to use mobile money. Beyond mobile money, many users in these three markets, as well as in Kenya and Senegal, cited a limited ability to use a phone. Notable levels of low literacy (reading and/or writing) were found to be limiting uptake in some of the surveyed markets. These responses suggest that digital and financial literacy initiatives, as well as inclusive user interface or user experience solutions (e.g., the GSMA’s Biometrics for All solution, which uses voice, face and fingerprint recognition), could contribute to closing the usage gap.

Despite the growth in registered accounts, financial inclusion does not end with access only. Mobile money providers, governments and other relevant stakeholders have a collective responsibility to make mobile money accessible and compelling to the widest possible audience, with a value proposition that can improve the day-to-day lives and financial health of consumers in LMICs. User feedback from the 2021 GSMA Consumer Survey indicates that reasons for low use are often similar to those for not having an account (see chapter 1 in the State of the Industry Report on Mobile Money). Tackling barriers for both offers a good chance to simultaneously improve mobile money access and use.

To find out more about the growth of mobile money, read through our milestone 10th State of the Industry Report on Mobile Money. In the meantime, please watch this space for the upcoming blogs within the series, addressing the topic of mobile money account activity rates.

Blog two on what providers can do to boost usage is out now.

* Kenya, Egypt, Nigeria, Senegal, Bangladesh, India, Indonesia, Pakistan, Guatemala, Mexico

[1] Question: “You said that you haven’t used your mobile money account in the last 30 days. For each of the possible reasons that I read out, please indicate whether this is something that stops you at all from using a mobile money account”. Percentages represent the proportion of respondents who answered “Yes”. Base: all adult mobile owners who have at least one mobile money account but who have not used mobile money in the last 30 days. n= 30–89. Samples are nationally representative, but should be interpreted with caution, due to their small size. Note: Guatemala and Mexico were excluded due to the small sample size, but are included under “total”.

[2] The specific question in our consumer survey was: “I do not have enough money for mobile money to be useful for me”.