This blog explores the changing mobile money gender gap across low- and middle-income countries, based on GSMA’s analysis of the latest 2021 Findex data and previous 2017 data

Mobile money continues to be a driving force, transforming the financial inclusion landscape in low- and middle-income countries (LMICs). Since 2014, mobile money accounts grew by 11 percentage points in developing economies, and by eight percentage points for women. For those without a traditional bank account, mobile money offers a route to financial inclusion that is typically lower cost and easier to access. This can disproportionately benefit women who, because of cultural norms, family responsibilities or structural inequalities such as lower wages or education levels, usually face greater barriers than men to using formal financial services.

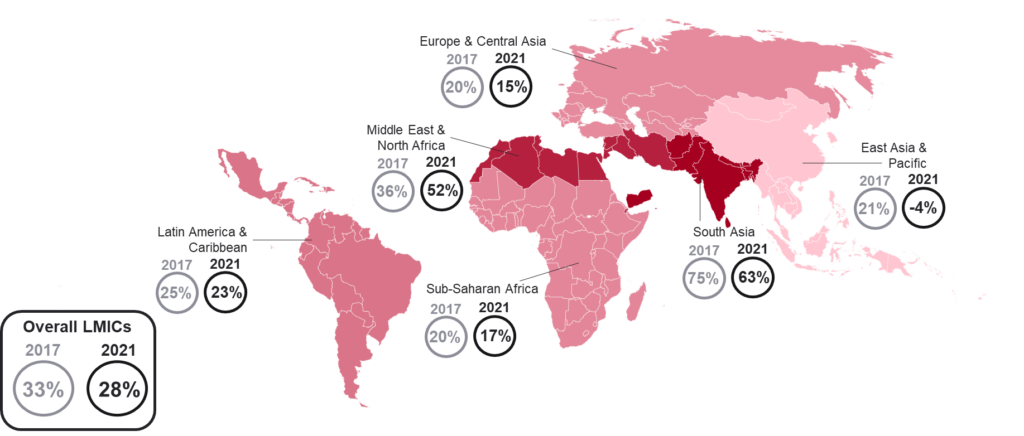

However, in 2021 women were 28 per cent less likely than men to own a mobile money account across LMICs. While this is an improvement from 2017 when women were 33 per cent less likely than men to own an account, it still represents a significant gap (Figure 1).[1]

The mobile money gender gap is slowly reducing, but progress is not equal across the world

Figure 1: Gender gap in mobile money usage in low- and middle-income countries

While the overall gender gap in mobile money account ownership is slowly reducing, there remains a persistently high gender gap in some regions, such as South Asia, where despite dropping from 75 per cent in 2017, it still has the largest gap at 63 per cent. In fact, the gender gap has remained relatively flat in Sub Saharan Africa and Latin America & Caribbean and has even widened in MENA. The overall improvement across LMICs can be attributed primarily to greater uptake of mobile money by women in South Asia and East Asia & Pacific.

Within regions, mobile money account ownership is also evolving unevenly. In Sub-Saharan Africa for example, the gender gap in account ownership in Côte d’Ivoire almost doubled from 21 per cent in 2017 to 41 per cent in 2021, despite the popularity of mobile money in the country. Crucially, women’s mobile money account ownership stayed at 30 per cent, whereas men’s grew from 38 per cent to 51 per cent. In Mozambique, the gender gap increased from 37 per cent to 43 per cent over the same period, as more men opened mobile money accounts than women. However, positive stories of growth in women’s mobile money account ownership are highlighted in the Findex data. For instance, the gender gap in Benin dropped from 52 per cent to 33 per cent and, in Togo, reduced from 41 per cent to 23 per cent, showing that women are signing up for accounts at a faster rate than men.

A range of factors prevent women from having a mobile money account

Before women can own a mobile money account, they face some important obstacles. For example, the GSMA’s research shows that women in LMICs are seven per cent less likely than men to own a mobile phone. This represents a critical preliminary barrier to adoption of mobile money services.

Mobile phones in Sub-Saharan Africa are central to account ownership in the economies in this region. Future progress, however, depends in part on ensuring that women have access to this crucial technology.

Findex 2021

Even among those that own a mobile phone and are aware of mobile money, there are other hurdles, many of which disproportionately impact women. The GSMA’s State of the Industry Report 2022 showed that women face a diverse range of barriers to mobile money account ownership. These included: a lack of perceived relevance, a lack of knowledge and skills and a lack of affordability, among many others.

Despite these challenges, mobile money services can provide a means of circumventing other barriers that can disproportionately impact women when seeking to open a financial account, such as the requirement for ID and distance to formal financial institutions. Crucially, once women own a mobile money account, they are almost as likely as men to have used it in the last 30 days (SOTIR 2022).

This latest data highlights that, while there has been some progress towards women’s financial inclusion, much more work is needed to ensure women are equally financially included. Collaborative, targeted actions to address women’s needs and barriers to using mobile money services is required to achieve greater financial inclusion for women. Doing so provides significant social and commercial benefits and is vital to achieving the United Nations Sustainable Development Goals (SDGs), in particular those related to gender equality and financial inclusion.

[1] In 2021, a number of markets were surveyed by phone instead of face-to-face (in particular, in Latin America, East Asia & Pacific and Europe & Central Asia). Therefore, regional and global comparisons may not all be like-for-like. Conducting mobile money inclusion research over the phone can influence results and skew findings to reflect better digital financial inclusion than is nationally representative. For more information, see section ‘Survey Methodology’ in Findex 2022.