This blog is a result of conversations with Sanivation’s team in Kenya. We’re extremely thankful to Effie Akinyi (Project Development Lead), Shadrack Omwenga (Project Development Manager), Kelvin Waweru (Partnerships Lead), and Dickson Ochieng (Director, Government Relations) for their time and thoughtful reflections. All of the images displayed in this blog are provided courtesy of Sanivation, unless otherwise stated.

Why we should all care about faecal sludge and wastewater

The last 20 years have seen many hundreds of millions of people gain access to improved sanitation, and the proportion of people with access to at least a ‘basic’ level of sanitation has increased. Yet, there are still approximately 420 million people without any facility, and a further 1.1 billion people with only ‘unimproved’ or only ‘limited’ services. Additionally, this progress has not been evenly distributed. While access rates have increased rapidly in South and Southeast Asia, many African countries’ expansion in services is only just keeping up with population growth.

Source: UNICEF/WHO SDG 6 monitoring – https://washdata.org/ [accessed July 2023]

However, access to a facility is only one side of the challenge in sanitation – how wastewater and fecal sludge is treated and safely disposed of is critical to ensuring environmental and human health. The malnutrition costs from poor sanitation in African and Asian countries are estimated at a staggering 9% of GDP. The contaminants in wastewater (from both human waste and industrial) pose serious environmental challenges, from endocrine-disrupting compounds from pharmaceuticals entering the food chain, to microplastics, to high levels of nitrogen and phosphorus causing algae blooms that choke aquatic life. We have extremely limited global data on wastewater treatment, but the current best estimates suggest that only 32% of wastewater flows receive some form of treatment.

What’s more, we are only just beginning to fully understand the relationship between sanitation and climate, and all signs point to a serious underestimation of the impacts. Recent studies indicate that wastewater and faecal sludge contribute 62% of the water sector’s total Green House Gas (GHG) emissions, including carbon, methane, and nitrous oxide. On-site sanitation alone (i.e. excluding emissions from sewer access) is estimated to generate roughly 5% of global methane emissions, and the water sector taken together accounts for approximately 10% of all global GHG emissions. The proportion of emissions from sanitation is also particularly high in cities. A recent whole-systems analysis of greenhouse gas emissions from citywide sanitation in Kampala, Uganda, suggests sanitation may represent more than half of total city-level emissions. In short, the list of impacts is long, and the cost high.

The sanitation sector has also suffered decades of underinvestment, and this is nowhere more visible than in the rapidly growing secondary cities across Africa and Asia. Secondary, or intermediary cities, are generally defined as those with a population below a million people and are expected to account for most of the urban growth in the decades to come. By 2040, over two thirds of people moving to urban areas in African countries will be moving to secondary cities. These cities have very particular challenges compared to larger or capital cities, from a greater reliance on central government fiscal transfers to greater existing service gaps, to lower levels of capacity and difficulties in attracting talent. We discussed all of these at more length in a recent blog. A key need in intermediary cities is decentralised, modular, and scalable solutions that can be deployed rapidly to meet current needs and are also ready to scale as cities grow. In this context, we’re pleased to be able to profile the evolution of Sanivation’s model, and their work targeting this exact challenge.

Sanivation’s treatment technology

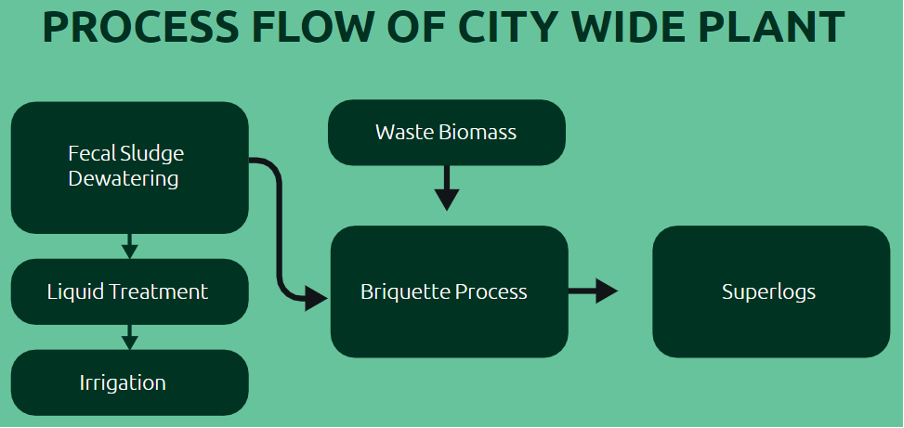

Sanivation started off as a container-based sanitation provider, with a model of collecting and treating fecal waste. In 2017, the GSMA gave the Container-Based Sanitation Alliance (CBSA) an innovation grant to digitalise the operations of their members (which includes Sanivation), all in an effort to support the commercial viability of these vital services. Sanivation have recently pivoted from managing household connections to being a partner for city municipalities and utilities to develop waste-to-value sanitation treatment facilities through planning and partnerships. Sanivation’s treatment technology is based on combining faecal waste with organic biomass to create ‘Superlogs’ as a product in their waste-to-value treatment plants. These Superlogs can be sold as a solid fuel, and each tonne of Superlogs saves two tonnes of CO2e, equivalent to 22 trees.

Sanivation’s partnership model

Sanivation has four main interlinked, product offerings for partner municipalities/utilities:

- Supporting city-wide inclusive sanitation planning

- Developing waste-to-value treatment plants

- Supporting managing waste collection

- Supporting municipal solid waste management.

Sanivation is currently working with 11 secondary cities in Kenya, they have clear eligibility criteria to inform a go/no go decision for the different cities, and each offering to the cities is tailored to their particular context.

Planning: A critical first step

In many secondary cities, long-term and costed plans, otherwise known as city-wide inclusive sanitation plans (CWIPs), for sanitation are non-existent. Sanivation’s first step with many of the utilities is to formulate these, with a focus on ensuring that the vital elements of Capex and resource reviver revenues are included and forecast. For example, in 2019 Malindi signed off on a 20-year plan for sanitation. This included a $94 million investment plan for the 20-year term. This plan built on an existing wastewater masterplan, but importantly, extended the ambition of this through including a feasibility study for a waste-to-value treatment facility. The original plans included provision for just a small faecal sludge treatment plant. This plan was critical to leveraging a KES 800m (~$6.3 million) public investment, funded from a debt deal held with the national government. This waste-to-value plants is currently under construction. Malindi’s model followed Sanivation’s work in Naivasha, where waste-to-value plant has already been constructed and is operational. Sanivation recently completed planning activities with Embu, Gusii, and Nyahururu that included: i) feasibility work for fecal sludge treatment facilities, ii) life cycle cost analysis, iii) detailed concept designs. Sanivation’s intention in working across multiple secondary cities is to create a portfolio of potential investments for public, commercial, and donor capital.

Getting the partnership model right

Sanivation is pursuing a design, build, operate, and maintain (D-BOM) PPP model for the construction and operation of treatment plants. Ideally, Sanivation is granted a concession to develop and run the facility while receiving payments on outcome indicators. Revenues from sanitation, usually and in this case, aren’t sufficient to cover the full costs of safely managed sanitation services (more on that from us here). As such, a public investment is nearly always necessary. With Sanivation’s preferred model, and in Malindi’s case, this comes in the form of a capital investment borne by the public sector. There are other models for partnerships, for example simply tendering for operate and maintain contracts, but these have discontents in the context of cost-recovery levels in sanitation.

The challenges with full cost-recovery in sanitation also points to the need to realise value from the waste. Most obviously, this is through the sale of the Superlogs (or whatever the outcome of the waste-to-value process may be). In a development context there are opportunities for outcome-based payments for services delivered, notably in the form of carbon credits. As mentioned in the introduction the sanitation sector is a major source of emissions, and the Superlog product has carbon-saving potential. Carbon credits based on faecal sludge or wastewater treatment have yet to be largely issued as this is such a new area of research and work, but there are several organisations actively working to develop the methodologies. Importantly, some of the sanitation treatment technologies have the potential to offset carbon emissions through removals, qualifying for higher value carbon credits. We recently published a blog on the potential of IoT and digital payments to enhance the effectiveness of results-based financing, and the experience from other sectors hold some lessons for sanitation.

The factors driving, and hindering, successful partnerships

Colleagues at Sanivation pointed to five critical factors enabling their partnerships:

- New sanitation mandate to water service providers – sanitation was recently made a new mandate to the water service providers (the utilities), and this has opened the space for discussions about sustainable innovations such as waste to value plants and other workable business models across the sanitation value chain.

- Enabling environment – strong leadership from the county governments and water service providers has been a key motivation to Sanivation. The buy-in and land allocation for operationalisation of the waste to value plants has been because of the trust and the enabling environment from the utilities, local, county, and national government.

- Clearly structured plans/shared vision and goals – as technical partners, Sanivation has worked together to clearly structure projects and clear plans and paths to achieving safely managed sanitation.

- Showcasing successful case studies – Naivasha and Malindi being pilots, Sanivation was able to deliver on their proposed value proposition around improved utility performance and financial sustainability. These proof-of-concept projects have been essential in attracting other investments, creating, ownership and encouraged successful partnerships.

- Ownership of the problem – commitments and ownership from the utility to deliver on the sanitation mandate have been key to successful partnerships. This flows from having dedicated sanitation units to provide oversight on: budget allocation in the business, strategic and county plans, and joint fundraising with Sanivation.

At the same time there remain some barriers to overcome:

- Governance – changes in leadership teams/board members can affect stability and the rate of progress. Changes require efforts from Sanivation to (re)gain the trust, build champions, and realign the sanitation vision with the new leadership teams, both at the county and utility level.

- Delayed decision making – prolonged decision-making processes in PPP projects can arise from conflicting priorities, political interests, and bureaucratic hurdles. All of these have stalled the implementation of partnerships for Sanivation.

- Limited resources towards sanitation – Sanitation is viewed as less attractive with no clear revenue options. Sanitation mostly receives zero to limited budget allocation, and shifting this takes lots of effort to change mindsets. Large established utilities are more advanced in terms of having a dedicated sanitation unit to oversee sanitation and have investments in sanitation. This is not seen in small utilities, where most focus is on water services and investments.

- PPP procurement structures – despite the PPP Act and progress from Sanivation in developing workable models,there is still lack of clear procurement structures for DBO and PPP.

Looking forward

We’d like to thank Sanivation colleagues for their time and thoughtful reflections in preparing this blog. We’re excited about their work as it really targets some of the very toughest issues facing intermediary cities, and in a sector beset with deep challenges. We’re excited about what their evolving partnership model means for accelerating access to sanitation in Africa’s secondary cities, and how getting this right can accelerate finance to the sector. This year both the GSMA and Sanivation will be at the Stockholm World Water Week, to find out more about our involvement there and our contribution to that conference, read our blog covering the event.

The Digital Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.