This is the second in a series of blogs focusing on the findings of the 2019 State of the Industry Report on Mobile Money.

Blog #1 | Blog #3 | Blog #4| Blog #5 | Blog#6 | Blog #7

With over one billion registered accounts and counting, the mobile money industry is uniquely positioned to take financial inclusion beyond access and usage- providing low-income individuals and households a pathway to prosperity. Supporting consumer financial resilience is a critical part of this pathway. In this blog, we will unpack how mobile money services are helping the world’s poor build resilience.

Our insights are based on the findings from our annual Global Adoption Survey, which was revamped in 2019 to include new questions on mobile-enabled savings, credit and insurance. This enhanced focus on adjacent services is part of GSMA’s mission to support the industry’s transition to the ‘payment as a platform’ model. By offering ever more customer-centric adjacent products and diversifying revenues, providers are set to increase the sustainability and reach of mobile financial services.

Mobile money is cultivating a formal saving culture, which would ultimately empower individuals and households to plan for future financial needs and weather income shortfalls

- At least 26 million unique customers saved via mobile money in the month of June 2019 alone, a 39 per cent increase from 2018. Over the same period, more than $241 million was transferred to mobile money-enabled savings accounts.

- Savings account data, combined with mobile money transactional data, are powerful tools for determining users’ financial profiles, paving the way to advanced financial services and supporting loans and insurance applications. For example, services like M-Pawa by Vodacom and CBA in Tanzania offer microcredit linked to savings accounts, enabling individuals and households to anticipate and plan for the future.

- The mobile money industry is uniquely positioned to help savings groups go digital. First attempts at digitising savings groups have seen mobile money providers either launching theirs, such as M-PESA Chama in Kenya, EcoCash Savings Club in Zimbabwe and M-Koba in Tanzania, or partnering with start-ups that have developed dedicated products to run on their mobile money rails, such as Ensibuuko.

Mobile money is bridging the information gap between lenders and borrowers

- With only 33% of the world’s adult population covered by a credit bureau, lenders frequently lack the information necessary to provide credit responsibly, often resulting in creditworthy applicants seeing their loan applications rejected.

- Mobile money transactional data yield powerful information about users’ financial behaviour, a proxy of creditworthiness, leading to a more accurate evaluation of their ability to repay.

- In June 2019 alone, $417 million worth of digital loans were processed by mobile money providers. The number of deployments offering credit grew by 25 per cent in 2019, and nearly 70 per cent of respondents offering credit are partnering with a regulated financial institution.

- Research by MicroSave Consulting demonstrates the success of this partnership model. Between 2016 and 2018, despite the growth in the volume of loans disbursed, nonperforming loans in Kenya decreased by 20 percentage points for mobile money providers that had partnerships with banks.

Mobile-enabled insurance is showing promising signs of growth, offering a safety net to vulnerable populations during emergencies

- It is a common saying that insurance is not bought, it’s sold. Lack of products tailored to customers’ needs is leaving 3.8 billion potential customers underinsured in emerging markets.

- MNOs are increasingly embracing insurance as part of their product offerings. Over 14 million new policies were issued in 2019 alone.

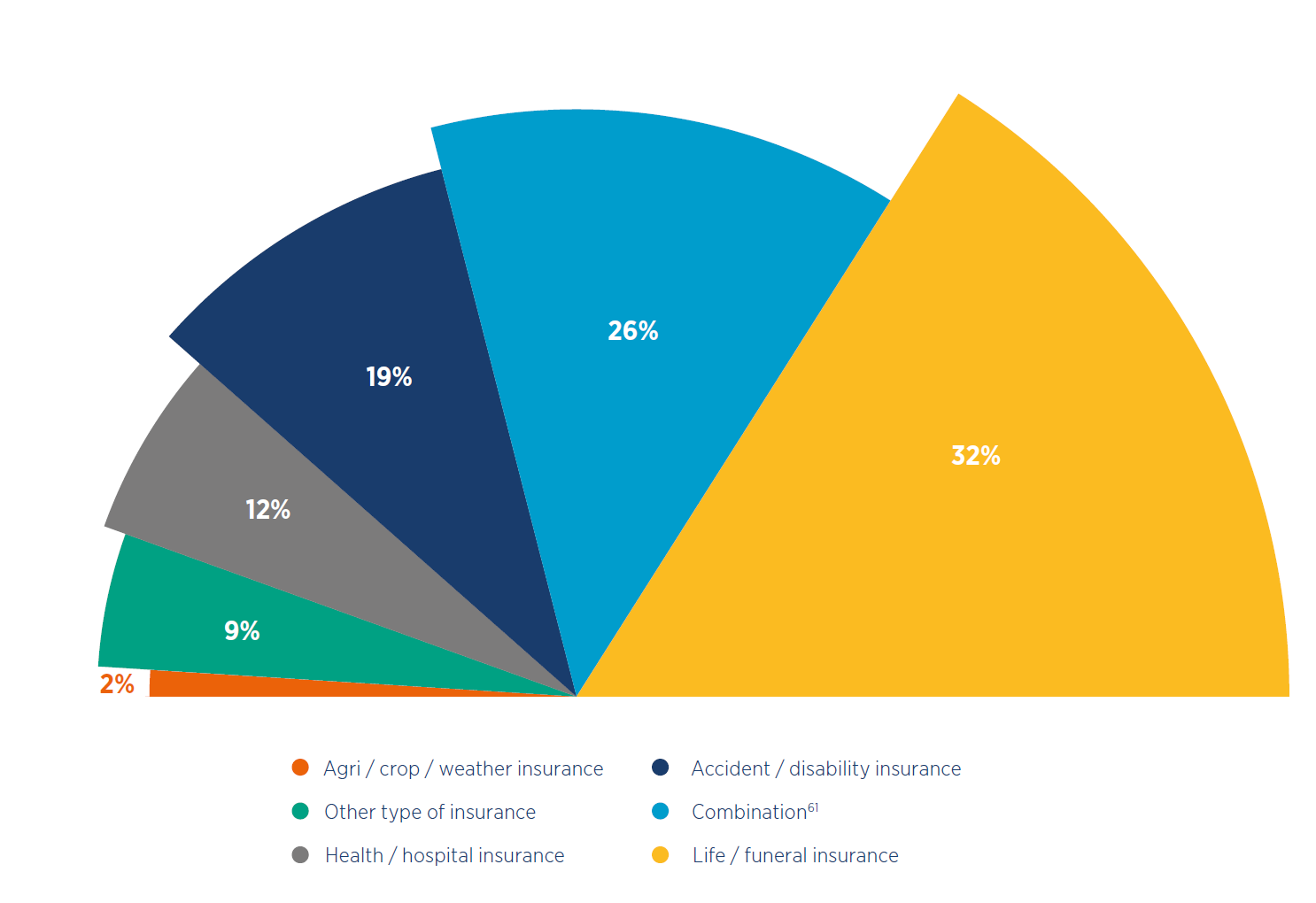

- As of December 2019, there were 102 mobile-enabled insurance services in 27 countries. The top three product offerings in 2019 were life, health and accident. Most commercial models in use are premium-based, confirming earlier trends.

Share of active mobile-enabled insurance products, December 2019

- While these developments are encouraging, inclusive insurance has untapped potential for the mobile money industry. By building comprehensive data and analytics capabilities based on usage patterns, mobile money providers have the chance to make insurance more relevant to the most vulnerable.

- As platform models in the mobile money industry become commonplace, insurance providers, including technical service providers and start-ups, can be efficiently matched with users. Subsequently, providers will be able to reach new customers with targeted products, boosting the value proposition and perceived attractiveness of mobile-enabled insurance.

A lot has happened since we analysed the data collected via our Global Adoption Survey. With half of the world’s population now under lockdown and a considerable proportion of the people across emerging markets heavily reliant on daily incomes, having the tools to cope financially and weather economic shocks is more critical than ever. The GSMA will continue to monitor the impact of this crisis on mobile money-enabled adjacent services grounded in field experience and real data.