In October 2023 as part of MWC Kigali, the GSMA Innovation Fund hosted a panel session on sustainable impact in Africa, hearing from both start-ups and investors. This builds on our initial webinar that launched our report on Scaling Digital Innovation in Emerging Economies.

The panel in Kigali briefly introduced several pathways to scale identified in the Scaling Digital Innovation report and shared more on GSMA’s role in combining catalytic funding and technical assistance, and MNO partnerships helps start-ups to scale.

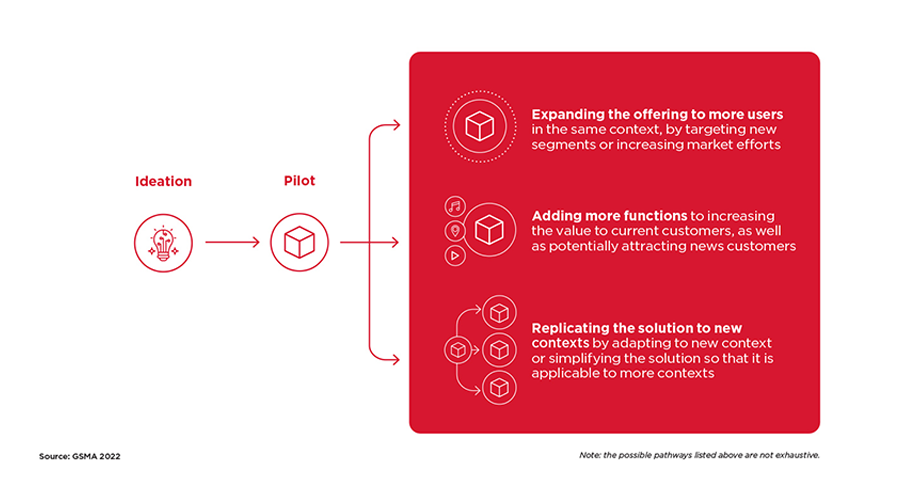

The pathways to scale

| The speakers included: Luisa Odell, the UK Foreign Commonwealth and Development Office (FCDO) Start-ups Gerald Otim, Ensibuuko (Uganda) Michael Ogundare, Crop2Cash (Nigeria) Elizabeth Okuneye, Hello Tractor (Nigeria) | Investors Serge Priam Nsanzineza, Rwanda Innovation Fund Eva Waweru, Village Capital Niklas Simola, FinnFund |

Reducing the funding gap through catalytic finance

Opening the discussion at MWC Kigali 2023, Luisa Odell, Innovation Adviser from FCDO, outlined the catalytic role that FCDO plays in supporting innovative entrepreneurs on their journeys to scale. She reiterated that the private sector, supported by development finance, has a vital role to play in scaling solutions that support the SDGs. For example, to help countries tackle climate change, the UK government has committed to spending £11.6 billion from 2021-2026 on climate finance, and the UK and Rwanda co-chair the new Access to Climate Taskforce. Through the GSMA Innovation Fund for Climate Resilience and Adaptation, the GSMA and FCDO are supporting 12 innovative climate tech start-ups including Lersha in Ethiopia, which is harnessing digital technology for climate resilience for some of Ethiopia’s poorest farmers.

Demonstrating different pathways to scale

Elizabeth Okuneye, Head of Customer Success at Hello Tractor, said that the key to their scaling journey is being both data-driven and customer-centric. Hello Tractor connects tractor owners and smallholder farmers in need of tractors, helping farming communities improve planning and preparedness amidst unpredictable rainfall patterns. Their team adapted to respond to the immediate needs of their customers, as Elizabeth said that the way to retaining customers is by listening to them. Despite the challenges of the national lockdown in 2020 and losing that crucial face-to-face interaction with customers, Hello Tractor now has 1.7m acres of farmland under their management and over 1,500 fleet owners. Hello Tractor attributes this success to smart decisions that combine the collection of feedback from customers with their wealth of data. In being both data-driven and actively listening to their customers, Hello Tractor is an example of expanding their current offering to their users in the same context.

Talking about the next step in their scaling journey, Michael Ogundare, CEO of Crop2Cash, shared more on their plan to launch an AI module. Crop2Cash supports farmers facing drought conditions to adapt their farming practices through climate-smart farming content and helps customers manage financial risks through their digital marketplace, connecting farmers to high-yield, drought-resistant maize seeds via USSD. Their new AI module provides real-time agri-advisory services to smallholder farmers in local Nigerian languages via a toll-free number. This AI-enabled call centre would be the first of its kind in Africa. In terms of the pathways to scale identified in our report, Crop2Cash’s journey is an example of adding more value by increasing the number of functions available to their customers, such as the call centre.

Gerald Otim, Founder and CEO of Ensibuuko, shared the exciting news of their expansion into Malawi, where they already have 50,000 users due to their partnership with United Nations Capital Development Fund (UNCDF) and Community Savings and Investments Promotion (COMSIP). Ensibuuko is a fintech company working to promote the adoption of digital financial products and improving access to devices and mobile services in rural areas. Through this expansion, Ensibuuko will provide a digital ledger platform for COMSIP’s farmer groups that allows them to automate their transaction and operations. They will also jointly layer tailored, affordable, and relevant digital financial services such as credit, savings, and insurance offerings, and digital financial literacy provided by advisors, to connect the unbanked and underserved to the wider financial ecosystem in Malawi. Ensibuuko tested their solution in Uganda and established key strategic partnerships to gain traction, with no less than 380,000 Ugandan customers. This resounding success provided the foundation for their replication into Malawi (a market with similar characteristics). In terms of different scaling pathways, Ensibuuko has therefore modelled the example of scaling through replication.

Providing support through funding and technical assistance

Organisations like Village Capital play a critical role to help build ecosystems and prepare start-ups for further investment. Eva Waweru from Village Capital shared more on their VIRAL pathway tool for ranking start-ups in terms of the necessary start-up milestones for investor readiness, and their use of other tools (such as peer selection) and research to do individual needs assessment of of their start-up portfolio. Village Capital tries to understand the challenges that entrepreneurs face and then develop relevant tools and research, such as their most recent tool, the Capital Explorer, which helps entrepreneurs identify capital structures that work best for them. This type of early-stage support can help start-ups plot the course and navigate their fundraising journey.

From his own experience as an entrepreneur, Serge Priam Nsanzineza from the Rwanda Innovation Fund encouraged entrepreneurs to learn by doing, and that the journey of entrepreneurs is that of growth. He shared more on the ecosystem building activities of the Rwanda Innovation Fund, that they not only supply funding but also tailored ecosystem support. Beyond that, the Fund has made strategic partnerships to support initiatives in sexual and reproductive health, and they have a corporate innovation programme that helps to connect corporates to start-ups.

Finally, Niklas Simola from Finnfund shared more on their activities in five key sectors: energy, agriculture, forestry, financial inclusion and digital infrastructure, and that they focus on growth-stage investment (Series B and above). He also shared more on the difference between investing in asset-heavy and asset-light start-ups, in that asset-heavy models often require their own infrastructure in smaller cities and rural areas to ensure quality and reliability for their customers. Beyond financial support, Finnfund extends their network for additional fundraising as well as promoting synergies between portfolio companies within sectors. Finnfund does impact surveys with 60 Decibels to provide a clearer understanding of their end customers and how their products improve their customer’s lives. Niklas ended with the news that Finnfund will be offering technical assistance to go that extra mile and provide their portfolio companies with product development, understanding their social and global impact, and staff training.

Watch the recording

We would like to extend a special thank you to all the speakers for their insightful participation in this MWC Kigali panel.

THIS INITIATIVE IS CURRENTLY FUNDED BY UK INTERNATIONAL DEVELOPMENT FROM THE UK GOVERNMENT AND THE SWEDISH INTERNATIONAL DEVELOPMENT COOPERATION AGENCY (SIDA), AND IS SUPPORTED BY THE GSMA AND ITS MEMBERS.