Seamless Integration

Seamless Integration

Mobile money continues to grow exponentially across developing markets. The seamless integration of service providers and mobile money platforms is key to providing underserved people with wider access to critical products. By providing easily accessible APIs, operators can create almost endless opportunities to build additional services on top of mobile money as well as opportunities to monetise those services.

This workstream is dedicated to mobile money APIs for seamless integrations. Offering the industry with forefront research and guidance on technological best practices to support operators to move towards a ‘payments as a platform’ (PaaP) model – one of the core facets of the GSMA’s vision for the future of mobile money.

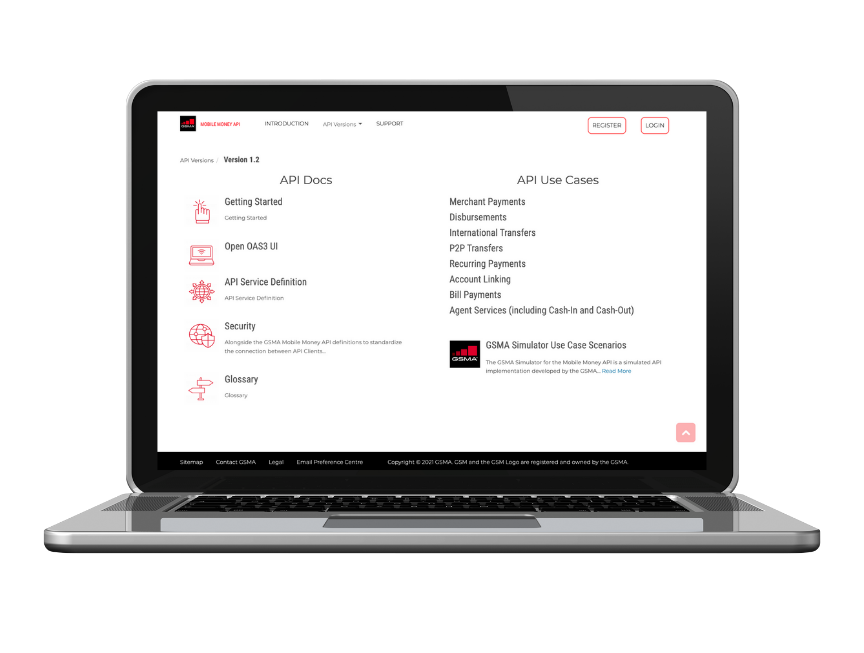

GSMA Mobile Money API

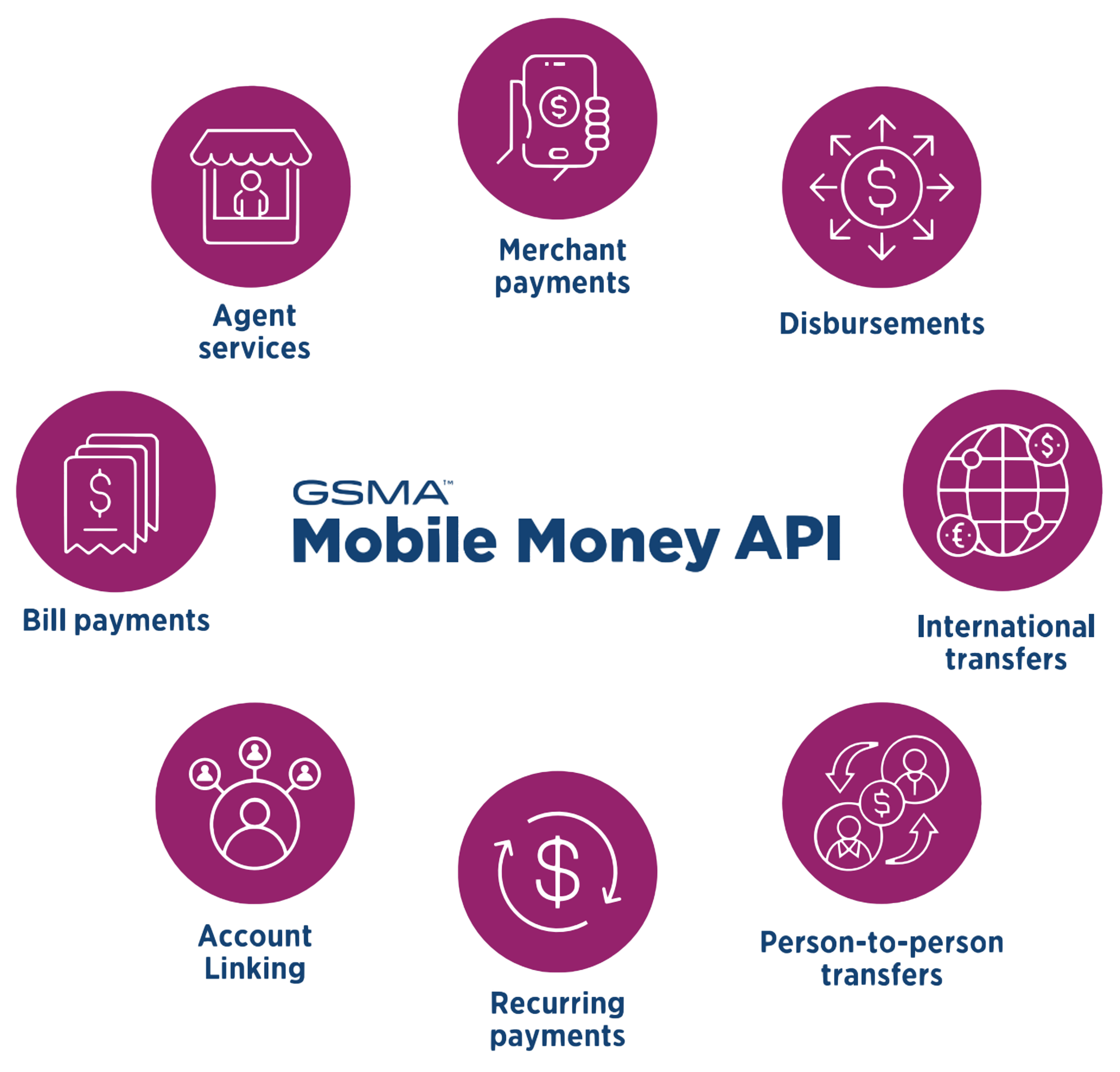

The GSMA Mobile Money API is an initiative developed through collaboration between the mobile money industry and the GSMA. It was created to support the mobile money industry speak the same technical language by providing a modern harmonised API for mobile money transactions and management that is both easy to use and secure.

The GSMA harmonised API initiative aims to increase adoption of the mobile money API through dedicated engagement with mobile money providers and support for ecosystem vendors. The GSMA also aims to maintain updated versions of the API Specification with new features and up to date functionality.

This common technical language, the API Specification, enables easy integration between mobile money providers and organisations who want to interface with these providers, by allowing any third party to implement a common solution which will work with all mobile money platforms which implement the API. The API is based on RESTful principles, a common easy to use set of principles used in modern APIs which provide benefits such as flexibility and scalability. The Specification also provides best practice security recommendations to ensure a high level of security.

If you are interested in adopting the Mobile Money API or wish to know more about existing adopters, please contact us at [email protected].

Governance

The GSMA Mobile Money API specification is governed though a working group adhering to the GSMA’s Procedures for Industry Specifications. Any organisation working with mobile money services, including all providers and consumers of mobile money APIs are invited to join and contribute to the working group. The mandate of the working group is to advance the GSMA Mobile Money API specification.

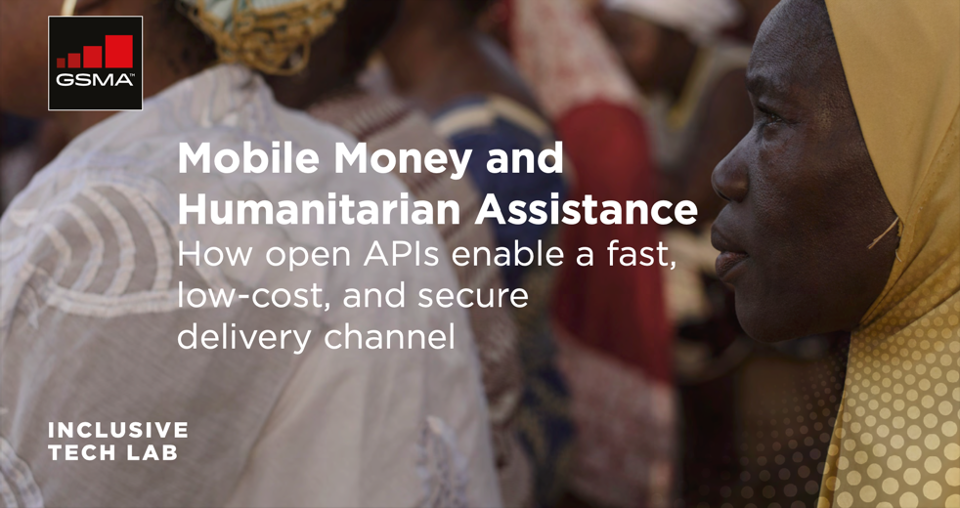

Mapping the GSMA API to UN Sustainable Development Goals

The mobile money industry has long been associated with supporting the financial inclusion of underserved users.

With the introduction of use case views in the latest version of the Mobile Money API, the GSMA have provided insights into how an enhanced API ecosystem built through the use of the harmonised API can address some of the remaining barriers in reaching underserved users.

The GSMA Mobile Money API as an enabler for Sustainable Development Goals report examines the ways in which the Mobile Money API contributes towards the UN Sustainable Development Goals. The contributions to SDGs are identified for each of the use cases that the GSMA Mobile Money API enables using a mapping approach which can also be visualised using a dynamic infographic.

Compliance Verification Service

The GSMA Mobile Money API Compliance Verification Service is designed to support mobile money providers and third-party service providers who wish to comply with the industry specification. Compliance indicates an API provider has implemented the API for the use cases which are relevant to their business.

Download the service brochure to find on how more about the service and how to enrol.